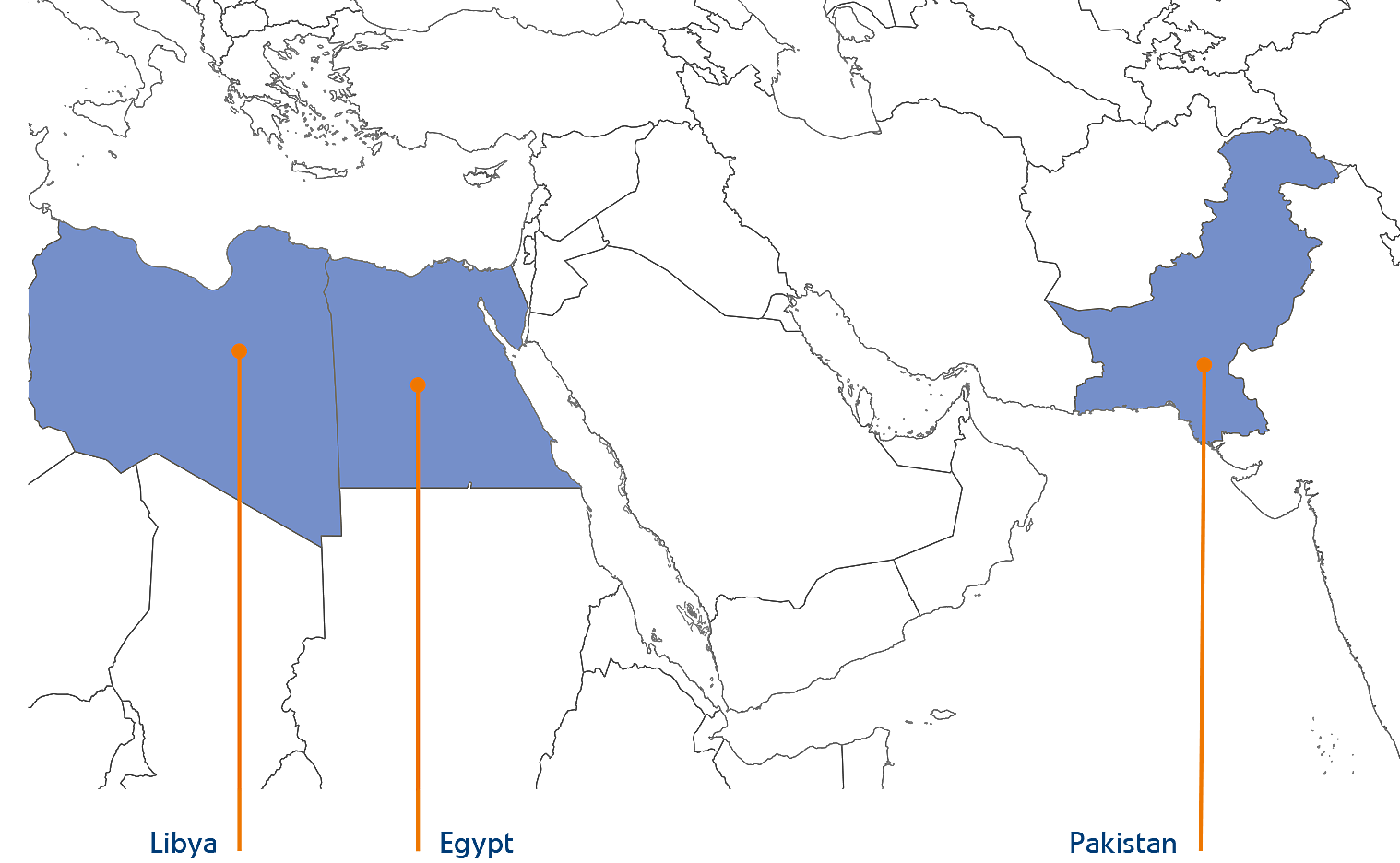

Foreign licences

Egypt

| Licence: | Bahariya (discontinued) |

|---|---|

| Interest holders: | PGNiG (100%) |

In Egypt, PGNiG conducted exploration work in the Bahariya licence area (Block 3) under a licence agreement executed with the government of Egypt on May 17th 2009. The Company held a 100% interest in the licence.

In 2013, two exploration wells were drilled, but the wells were abandoned as they did not flow hydrocarbons at commercial rates. The Bahariya licence’s potential was re-evaluated based on newly acquired geological data, which proved that further work was not economically viable. The licence was discontinued and the Egypt Branch was closed.

Pakistan

| Licence: | Kirthar |

|---|---|

| Interest holders: | PGNiG (70%) |

| Pakistan Petroleum Limited (30%) |

PGNiG conducts exploration work in Pakistan on the basis of an agreement for hydrocarbon exploration and production in the Kirthar licence area, executed between PGNiG and the government of Pakistan on May 18th 2005. Work in the Kirthar block is conducted jointly with Pakistan Petroleum Ltd, with production and expenses shared proportionately to the parties’ interests in the licence: PGNiG (operator) – 70%, Pakistan Petroleum Ltd – 30%.

On July 6th 2012, the Pakistani licencing authority (Directorate General of Petroleum Concessions) classified the Rehman field as a deposit of unconventional tight gas. As a consequence, the interest holders can raise its prices by 50% relative to prices of gas produced from conventional reserves. In 2012, PGNiG decided to move on to the second exploration stage on the Kirthar licence, as part of which a new exploration well is to be drilled by July 2014. In 2013, the construction of pipelines and provisional surface installations was completed and test production from the Rehman-1 and Hallel X-1 wells began. The gas produced is sold to the Pakistani transmission system. Preparations were also underway for the drilling of the Rizq-1 well, scheduled for 2014.

Libya

| Licence: | blok No. 113 |

|---|---|

| Interest holders: | PGNiG (100%) |

In February 2008, Polish Oil and Gas Company – Libya BV signed an Exploration and Production Sharing Agreement (EPSA) with National Oil Corporation of Libya, authorising the company to carry out exploration work on Exploration and Production Licence No. 113 with an area of 5.5 ths km2. The licence is located within the Murzuq crude oil basin, in western Libya.

Following the outbreak of civil war in Libya, a decision to evacuate all foreign personnel from the country was made in February 2011. In agreement with National Oil Corporation, the performance of the EPSA was suspended by force majeure. In the second half of 2012, the force majeure event was declared to be ceased and exploration work was then resumed.

In 2013, the company completed preparatory work and commenced the first round of drilling, which is to consist of four exploration wells. The first exploratory well yielded a natural gas discovery, which was recognised by the company’s Libyan partner, National Oil Corporation. The drilling and production tests on the second well ended in December 2013. Also in 2013, the company completed preparatory work on the third well, while the second-stage 3D seismic surveys, originally scheduled for 2013, were postponed for future years.

Following analysis of the economics of the project, with consideration given to the expected hydrocarbon volumes from the Libyan licence and unstable political situation in the country, the PGNiG Management Board made a decision to recognise impairment losses, as at December 31st 2013, on all shares and contributions to the POGC – Libya BV share capital, and to recognise a provision for all outstanding licence liabilities of the Murzuq project in Libya.

Any decision to continue the work will depend on the results of further geological surveys and economic analysis as well as political developments in Libya itself.

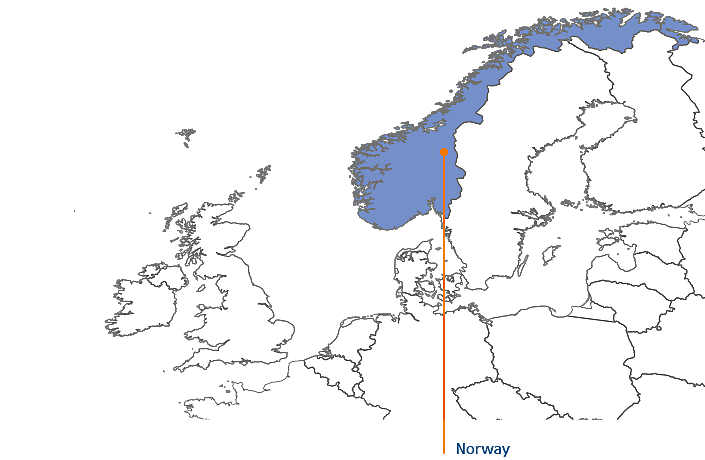

Norway

| Licence: | PL159, PL212, PL212B, PL262 – SKARV PROJECT |

|---|---|

| Interest holders: | PGNiG UI (11.9%) |

| BP Norge (23.8%) – operator | |

| Statoil Petroleum (36.2%) | |

| E.ON Ruhrgas Norge (28.1%) |

In late 2012, PGNiG Upstream International AS, in cooperation with its partners, launched oil and gas production from the Skarv deposits. Thus, PGNiG became the first Polish company to produce significant volumes of oil and gas under an international project. The project was also PGNiG’s first offshore production venture.

The Skarv field is located in the Norwegian Sea, approximately 210 km west off the coast of Norway, where the sea depth ranges between 350 m and 450 m. The field was discovered in 1998, and its recoverable reserves (as at December 31st 2013) are estimated at: 44.5 bn m³ of gas, 13.6 m m³ of crude oil with condensate, and 5.4 m tonnes of NGL. PGNiG UI holds rights to 11.9% of the reserves.

Until October 2013, the field was in the ramp-up phase, with cleaning, testing and bringing onstream of individual wells. Following this phase, the field is being operated through a total of 16 wells.

The Skarv project licence area (in the shallow-lying Cretaceous sequence) also holds two large gas and condensate discoveries, Snadd South and Snadd Outer. It is very likely that Snadd South, North and Outer constitute a single stratigraphic trap stretching across more than 60 km. If this assumption is valid, it will be the longest hydrocarbon accumulation discovered on the Norwegian Shelf.

Hydrocarbon production from the Skarv project is carried out using the state-of-the-art FPSO (floating production, storage and offloading vessel), anchored near the field. The FPSO, built in South Korea, is the world’s largest vessel of this kind, able to operate in rough weather conditions. The vessel’s hull is 295 m long and 51 m wide, and its capacity is 140 ths m³ (880 ths barrels).

| Licence: | PL212E |

|---|---|

| Interest holders: | PGNiG UI (15%) |

| BP Norge AS (30%) – operator | |

| Statoil Petroleum AS (30%) | |

| E.ON E&P Norge AS (25%) |

A well drilled in the licence area in 2012 discovered the Snadd Outer natural gas and condensate deposit in the Lysing Cretaceous formation. According to initial estimates, its in-place resources amount to 3.7 bn m³ of gas and 0.23 bn m³ of condensate.

There are plans for evaluating its reserves together with those of Snadd South and Snadd North within the Skarv project, and to prepare a development plan (geological documentation, Plan of Development and Operations).

| Licence: | PL558 |

|---|---|

| Interest holders: | PGNiG UI (30%) |

| E.ON Ruhrgas Norge (30%) – operator | |

| Det norske oljeselskap (20%) | |

| Petoro (20%) |

The licence, awarded in the APA 2009 licencing round in early 2010, is located in the immediate vicinity of the Skarv field. The vicinity of the Skarv FPSO platform will ensure profitable gas and oil exports if hydrocarbons are discovered in the licence area.

Work carried out since the licence award includes reprocessing and interpretation of the existing 3D seismic profiles and additional geological studies, confirming the prospectivity of the area. The area covered by the licence has considerable exploration potential, with likely oil and gas presence. In early 2012, the interest holders decided to proceed with an exploratory well using the Borgland Dolphin platform. The work is scheduled to commence in mid-May 2014.

| Licence: | PL646 |

|---|---|

| Interest holders: | PGNiG UI (20%) |

| Wintershall Norge (40%) – operator | |

| Lundin Norway (20%) | |

| Norwegian Energy Company Noreco (20%) |

Norwegian Energy Company Noreco 20% At the beginning of 2012, PGNiG UI acquired interests in the PL646 licence in the Norwegian Sea. The licence area is adjacent to the Skarv field, which is in line with the company’s strategy.

Work carried out since the licence award includes purchase and interpretation of 3D seismic profiles and additional geological studies, confirming the prospectivity of the area. On the basis of this work, a decision was made to postpone the drill-or-drop decision until February 2015. If the decision to proceed is made, the well should be drilled within two years.

| Licence: | PL648S |

|---|---|

| Interest holders: | PGNiG UI (50%) – operator |

| OMV Norge (50%) |

The PL648S licence is of special importance to PGNiG as the first licence ever under which the Company will perform the responsible role of operator on the Norwegian Continental Shelf. Having been granted the operator status is an important step for the PGNiG Group. It is the first operatorship of an offshore exploration project, which emphasises PGNiG Norway’s role as the Group’s competence centre for offshore operations.

The licence area is adjacent to the Skarv field and has huge exploratory potential, with a likely natural gas discovery. New 3D seismic, acquired over the licence area in 2012, is currently being processed. The partners will also carry out geological and geophysical analysis to assess the prospectivity of the area.

The drill-or-drop decision has been postponed until the third quarter of 2014. If the decision to go forward is made, the well should be drilled within two years.

| Licence: | PL702 |

|---|---|

| Interest holders: | OMV Norge (60%) – operator |

| PGNiG UI (40%) |

The licence was acquired in the 22nd licencing round in June 2013. It is located within the Vøring basin, where the sea depth exceeds 1,000 m. The licence area is expected to hold a large gas accumulation in Sandy Cretaceous sediments.

A 3D seismic profile was acquired over the area in 2013 and is now used for geological and geophysical studies.

Final evaluation of the licence’s potential, including specification of the exploration risks, will be made in the first quarter of 2015 before the drill-or-drop decision, scheduled for the second quarter of 2015.

| Licence: | PL703 |

|---|---|

| Interest holders: | OMV Norge (60%) – operator |

| PGNiG UI (40%) |

The licence was acquired in the 22nd licencing round in June 2013. It is located within the Vøring basin, where the sea depth exceeds 1,000 m. As in the case of the PL702 licence, the area is expected to hold a large gas accumulation in Sandy Cretaceous sediments.

A 3D seismic profile was acquired over the area in 2013 and is now used for geological and geophysical studies. Final evaluation of the licence’s potential, including specification of the exploration risks, will be made in the first quarter of 2015 before the drill-or-drop decision, scheduled for the second quarter of 2015.

| Licence: | PL707 |

|---|---|

| Interest holders: | Edison (50%) – operator |

| PGNiG UI (30%) | |

| North Energy (10%) | |

| Lime Petroleum (10%) |

The licence was acquired in the 22nd licencing round in June 2013. It is located in the Barents Sea, where the sea depth is around 400 m. The licence area is expected to hold gas and oil in Carboniferous, Permian and Triassic formations.

A 3D seismic profile was acquired over the area in 2013 and is now used for geological and geophysical studies.

The drill-or-drop decision is expected in the second quarter of 2015.

| Licence: | PL711 |

|---|---|

| Interest holders: | Repsol (40%) – operator |

| PGNiG UI (20%) | |

| OMV (20%) | |

| Idemitsu (20%) |

The licence was acquired in the 22nd licencing round in June 2013. It is located in the western part of the Barents Sea basin, where the sea depth is around 400 m. The licence area is expected to hold a large gas accumulation in Tertiary formations.

A 3D seismic profile was acquired over the area in 2013 and is now used for geological and geophysical studies.

The drill-or-drop decision is expected in the second quarter of 2015.

| Licence: | PL756 |

|---|---|

| Interest holders: | PGNiG UI (50%) – operator |

| Rocksource (25%) | |

| Idemitsu (25%) |

The PL756 licence is the second offshore licence under which PGNiG UI has the operator status. It was acquired in the APA2013 round in January 2014. It is located a few dozen kilometres south of the Skarv field, where the sea depth is around 400 m. The licence area is expected to hold gas and oil in the Jurassic and Cretaceous formations.

Geological data compilation is currently underway, to be followed by detailed geological and geophysical studies required before the drill-or-drop decision is made. The decision is expected in the first quarter of 2016.