Strategy for the PGNiG Group

The ultimate strategic objective pursued by PGNiG SA is to deliver growth in shareholder value. In pursuit of that objective, in mid-2011 the Company adopted the “Updated Strategy for the PGNiG Group until 2015”. The strategy is being implemented taking into account the need to ensure the long-term security of uninterrupted gas supplies to the Polish market. In December 2012, the Company adopted the “Short-Term Value Creation Strategy for the PGNiG Group in 2012–2014”. This operational strategy is a set of coordinated activities geared towards achievement of the Group’s primary strategic objective. The document, adopted in December, is consistent with the “Updated Strategy for the PGNiG Group until 2015”.

The ultimate strategic objective pursued by PGNiG SA is to deliver growth in shareholder value. In pursuit of that objective, in mid-2011 the Company adopted the “Updated Strategy for the PGNiG Group until 2015”. The strategy is being implemented taking into account the need to ensure the long-term security of uninterrupted gas supplies to the Polish market. In December 2012, the Company adopted the “Short-Term Value Creation Strategy for the PGNiG Group in 2012–2014”. This operational strategy is a set of coordinated activities geared towards achievement of the Group’s primary strategic objective. The document, adopted in December, is consistent with the “Updated Strategy for the PGNiG Group until 2015”.

PGNiG is one of the largest companies in Poland - in terms of revenue and earnings, it ranks among the largest and most profitable Polish businesses. It is also one of Poland’s largest employers.

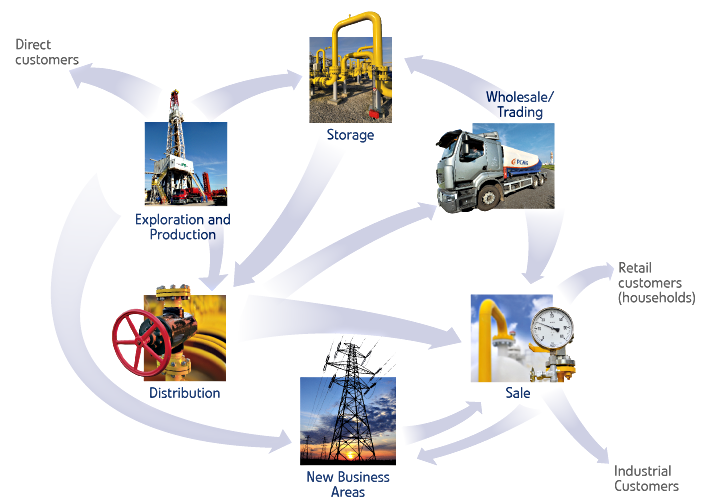

The Group’s main strategic objectives make up its vision to become, by 2015, a modern and efficiently managed organisation, controlling almost the entire value chain in the gas sector, and holding assets in the fuel and power sectors.Attaining these strategic objectives will depend on activities in three areas:

- hydrocarbon exploration and production domestically and abroad, to ensure access to new oil and gas reserves;

- the power sector, focusing on the development of gas-fired power generation in Poland;

- management of the natural gas portfolio in Poland and abroad.

The Short-Term Value Creation Strategy for the PGNiG Group until 2014 is a comprehensive document providing for a set of coordinated activities geared towards delivery of 19 initiatives broken down into three business areas:

Initiatives in the Upstream area:

- Appraisal and development of unconventional hydrocarbon reserves under licences held;

- Cooperation with external partners in the area of hydrocarbon exploration and production;

- Intensification of conventional hydrocarbons exploration in Poland;

- Optimisation of upstream operations outside of Poland.

Initiatives in the Market area:

- Enhancing efficiency in the marketing and customer service area;

- Implementation of an integrated product range;

- Implementation of a new marketing policy;

- Active participation in and support of the gas market deregulation programme;

- Development of the power segment;

- Change in pricing rules for gas import contracts;

- Change in the structure of imported gas sources;

- Centralisation of the wholesale trading function at the PGNiG Group.

Initiatives in the Business Model area:

- Optimisation of the HR management system at PGNiG;

- Implementation of a project/project portfolio management system;

- Establishment of a Shared Services Centre;

- Restructuring of the PGNiG Group’s core businesses;

- Restructuring of the PGNiG Group’s non-core businesses;

- Employment restructuring;

- Optimisation of the storage segment at the PGNiG Group.

Thanks to the Short-Term Value Creation Strategy for the PGNiG Group until 2014, the Company will be able to implement its ambitious investment programme, while reducing debt and generating surplus cash, which may be used to finance other investment projects.

Increasing the value of the PGNiG Group |

|||

|---|---|---|---|

| Maximising the potential of the PGNiG Group’s upstream segment | Preparing the PGNiG Group for the deregulation of the natural gas market | Optimising the portfolio of gas supplies | Restructuring the business model of the PGNiG Group |

| The upstream segment is currently prioritised in the PGNiG Group’s investment and development activities. In particular, PGNiG puts enormous emphasis on development in the area of exploration for and production of unconventional hydrocarbons. In this area, a number of initiatives are planned, to be implemented both by the PGNiG Group independently and in cooperation with external (domestic and foreign) partners. |

Currently, the PGNiG Group enjoys the leading position on the natural gas market in Poland. However, in view of the planned deregulation, competition is likely to emerge on the market in the near future, posing a threat to the Group’s position. It is PGNiG’s intention to take steps designed to adapt the PGNiG Group to the expected developments on the gas market (e.g., enhancing brand recognition, improving customer service, building demand for natural gas in the power sector or enhancing product offering). |

Terms and conditions of gas import (including gas prices) have a decisive effect on tariff prices for end users. High tariff prices adversely affect the competitiveness of natural gas as an energy carrier and hinders the market growth. PGNiG sees it its priority to permanently restructure the gas supply portfolio by amending price formulae under the existing contracts, turning the contracts into more flexible arrangements or identifying new competitive gas suppliers. |

The PGNiG Group’s current business model is not optimised, which prevents the Group from unlocking its full value growth potential. The extensive organisational structure, decentralised model of support functions and the high headcount adversely affect the Group’s process and cost efficiency. Implementation of restructuring initiatives (such as consolidation of the core business, unlocking capital tied-up in non-core activities and function centralisation) is of key importance. |