Key Events

- January

-

PGNiG, through its subsidiary PGNiG SPV1, acquired 99.8% of shares in Vattenfall Heat Poland SA (currently PGNiG Termika) for approximately PLN 3 bn. The acquisition was financed by PGNiG with proceeds from a notes programme. With this transaction, PGNiG has become a multi-utility group, supplying heat, electricity and gas to its customers.

For the fourth consecutive time, PGNiG was included in the prestigious group of companies making up the Respect Index, the CEE region’s first index of socially responsible businesses, compiled by the Warsaw Stock Exchange.

- February

-

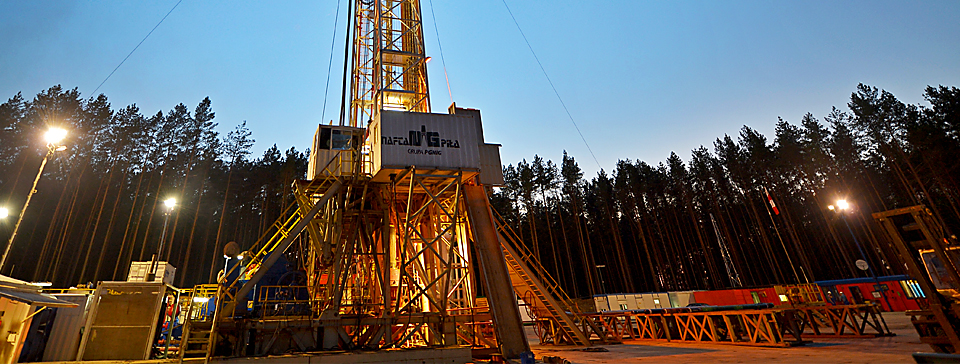

In licensing round APA2011, the Norwegian Ministry of Hydrocarbons and Energy awarded PGNiG Norway interests in three exploration and production licences in Norway: licence PL648S (PGNiG Norway (operator) 50%, OMV Norge AS 50%), licence PL646 (Wintershall Norge AS (operator) 40%, PGNiG Norway 20%, Lundin Norway AS 20%, Norwegian Energy Company ASA 20%) and licence PL350B, which is extended licence PL350 (EON (operator) 40%, PGNiG Norway 30%, Statoil 30%). Being awarded with operatorship of the PL648S licence is a significant step forward for the company. It is the first operatorship awarded to PGNiG Norway, and it highlights the company’s natural development.

PGNiG Finance issued the first, EUR 500 m tranche of five-year eurobonds as part of its Eurobond Programme established in August 2011.

PGNiG drafted the Gas Deregulation Programme, which was put to public consultation. The draft was prepared based on documents including the President of the Energy Regulatory Office’s recommendations for gas deregulation in Poland, dated November 15th 2011, as well as the Natural Gas Prices Deregulation Roadmap, dated December 22nd 2011. The purpose of the Programme is to create market conditions under which gas prices for institutional customers can be deregulated. PGNiG is aware that the Polish gas market may be subject to major changes post-deregulation.

On February 20th 2012, the Company filed a suit against OAO Gazprom and OOO Gazprom Export with the Arbitration Court in Stockholm, in accordance with the relevant procedure. The suit relates to changes of the price terms in the long-term gas supply contract of September 25th 1996 executed by PGNiG with OAO Gazprom and OOO Gazprom Export.

- March

-

The Supervisory Board appointed Ms Grażyna Piotrowska-Oliwa to the position of President of the PGNiG Management Board for the joint term of office expiring on March 13th 2014.

The President of the Energy Regulatory Office approved a new gas fuel tariff (Part A – Gas Fuel Supply Tariff No. 5/2012). On average, the prices and charge rates for the supply of high-methane gas type E, and nitrogen-rich gas types Lw and Ls were increased by 12.5%, 12.6% and 11.3%, respectively. The tariff came into force as of March 31st 2012.

- April

-

PGNiG completed construction of a high-pressure pipeline between the Kłodawa mixing plant and the LMG oil and gas production facility. The pipeline will enable the transmission of natural gas from the Dębno region, through the Kłodawa mixing plant and LMG oil and gas production facility, to the Grodzisk mixing and nitrogen rejection unit, and will be used as a storage facility to cover temporary shortages of nitrogen-rich gas.

In accordance with a decision of the President of the Energy Regulatory Office, PGNiG implemented a new Gaseous Fuel Storage Tariff, effective until March 31st 2013. In the new Tariff, the average rate of charges for gas storage services was reduced by approximately 7.9%.

A notice was given by BP, the operator of the Skarv project, that the launch of oil and gas production on the Norwegian Continental Shelf would be postponed from Q2 2012 to Q4 2012. The postponement was caused by a delay in the installation of risers due to adverse weather conditions on the Norwegian Sea.

The Stalowa Wola CHP plant signed a contract with Abener of Spain, to be the general contractor for the CCGT unit in Stalowa Wola. The contract, valued at PLN 1.57 bn (VAT exclusive), provides for construction of Poland’s largest gas-fired CHP plant and for long-term maintenance of the gas turbine.

The PGNiG Management Board resolved to recommend to the General Meeting transfer of the entire 2011 balance-sheet profit of PLN 1.62 bn to the Company’s statutory reserve fund. The PGNiG Management Board also proposed to allocate retained earnings of PLN 72.5 m to the Company’s statutory reserve funds. In May 2012, the PGNiG Supervisory Board endorsed the Management Board’s proposal.

- May

-

Mr Marek Karabuła resigned from his position as member of the PGNiG Management Board and took the position of President of the Management Board of POGC Libya, a PGNiG subsidiary conducting exploration activities in Libya.

PGNiG published its financial results for Q1 2012. The PGNiG Group posted a PLN 297 m net profit, down by 71% from PLN 1 bn in Q1 2011. One of the main reasons behind the decline, despite a 27% growth in revenue (to nearly PLN 9 bn), was a negative margin on sales of high-methane gas (-10%). This was, in turn, primarily attributable to a 41% increase in the unit purchase price of imported gas and the lack of a new tariff approval, for which PGNiG had already applied in October 2011. The Group’s revenue was up 27%, to almost PLN 9 bn, mainly on the back of a sharp rise in gas sales volumes and inclusion of PGNiG Termika in the consolidated financial statements. Once again, the Exploration and Production segment recorded a two-digit increase in revenue from exploration services.

PGNiG executed documents on a five-year note programme for up to PLN 4.5 bn with ING Bank Śląski SA and Bank Pekao SA. Under the programme, PGNiG may issue for private placement fixed or floating rate notes with maturities of up to 10 years.

PGNiG Termika completed the construction of a wet flue gas desulphurisation unit at the Siekierki CHP plant. The unit supports eight of the 14 boilers installed at the CHP plant and desulphurises emissions from 70% of its generating capacity.

- June

-

The Annual General Meeting of PGNiG approved the financial statements and the Directors’ Reports on the operations of PGNiG, as well as the consolidated financial statements and the Directors’ Report on the operations of the PGNiG Group, and granted discharge to members of the PGNiG Management and Supervisory Boards for the financial year 2011. The Annual General Meeting resolved to allocate the entire net profit and retained earnings for 2011, respectively of PLN 1.6 bn and PLN 72.5 m, to the Company’s statutory reserve funds.

PGNiG issued the first tranche of long-term bonds under the bond programme launched in May 2012. The nominal value of bonds issued was PLN 2.5 bn. At the time it was the largest bond issue ever completed on the Warsaw Stock Exchange by a non-bank corporate issuer.

- July

-

On July 4th 2012, PGNiG entered into a framework agreement concerning shale hydrocarbon exploration and production with KGHM Polska Miedź SA, PGE Polska Grupa Energetyczna SA, TAURON Polska Energia SA and ENEA SA. The agreement provides for joint exploration for, appraisal and production of hydrocarbons from geological formations covered by PGNiG’s licence for oil and gas exploration and appraisal in the Wejherowo area. The area on which the parties will operate spans approximately 160 square kilometres. Estimated expenditure on gas exploration, appraisal and production at the first three sites (the Kochanowo, Częstkowo and Tępcz pads) will amount to PLN 1.7 bn.

PGNiG Norway discovered a new field, Snadd Outer, within the PL212E licence area. The field lies near the Snadd North gas field and borders the Skarv field.

On July 30th 2012, the notes issued by PGNiG in June 2012 were floated on the Catalyst market, on the multilateral trading facility operated by BondSpot.PGNiG Termika executed documents on a five-year note programme for up to PLN 1.5 bn with four banks, i.e. PKO BP SA, Nordea Bank Polska SA, ING Bank Śląski SA and Bank Zachodni WBK SA. As part of the programme, PGNiG TERMIKA may issue (in private placements) discount and interest-bearing notes with maturities of up to one year and interest rates based on WIBOR+margin.

PGNiG Termika SA issued the first tranche of notes with a total nominal value of PLN 450 m.

- August

-

For the fifth time in succession, the Warsaw Stock Exchange announced the list of companies included in the Respect Index. PGNiG was again in the prestigious group.

PGNiG published its financial results for H1 2012. In H1 2012, the PGNiG Group recorded a PLN 17 m loss, relative to a PLN 1 bn profit reported for the corresponding period of the previous year. The loss was incurred despite a 28% growth in revenue, to PLN 14.8 bn, and was chiefly caused by factors outside the Company’s control, such as the rising cost of gas imports and adverse fluctuations in the złoty exchange rates, which the tariff approved by the President of the URE failed to offset.

On August 28th 2012, the PGNiG Management Board adopted a resolution concerning the Voluntary Termination Programme. Its adoption was a consequence of the Agreement concerning the process of PGNiG’s reorganisation, concluded on August 24th 2012 between the PGNiG Management Board and PGNiG’s Union Coordination Commission.

- September

-

Standard & Poor’s Financial Services (“S&P“, the “Agency”) reduced the rating of PGNiG from BBB+ to BBB and placed the Company on a watchlist with negative implications. It is S&P’s opinion that PGNiG’s 2012 performance will not stand up to the Agency’s earlier expectations, because of the Company’s reduced profitability brought about by the Polish system of gas fuel tariffs, preventing the Company from full and prompt covering of the cost of imported gas, and that the Company runs the risk of incurring operating loss in 2012. On the other hand, S&P assessed the Company’s liquidity as adequate given PGNiG’s investment programme, appreciating the available financing programmes of significant values.

PGNiG Norway and PST signed a contract on sale of gas produced from the Skarv field. The term of the contract, valued at approximately EUR 1.3 bn, is ten years. The selling price will be determined with reference to gas prices quoted on the European Energy Exchange (EEX), and payments for gas supply will be settled in EUR.

On September 13th 2013, PGNiG received a decision of the President of the Energy Regulatory Office, refusing to approve the changes in the gas fuel tariff.

Grupa LOTOS SA and PGNiG signed an agreement on joint commercial initiatives and cooperation in exploration for and production of conventional and unconventional oil and gas.

As exploration work in the PL350 and PL350B licence areas on the Norwegian Continental Shelf failed to confirm the assumed geology, PGNiG Norway discontinued work on the licences.

- October

-

PGNiG and VNG-Verbundnetz Gas AG executed amendment No. 1 to the Lasów Gas Sales Agreement. The parties agreed on a new pricing formula based on the prices of petroleum products and current market prices of natural gas, and set a new capacity charge rate.

PGNiG put the Lubiatów oil field and the Międzychód gas field on stream. The fields were developed as part of the Lubiatów-Międzychód-Grotów project, whose purpose is to facilitate the transport, storage and sale of crude oil, natural gas, liquid sulphur and propane-butane mix from the LMG oil and gas production facility. The launch of production from the Lubiatów and Międzychód fields will contribute to increasing overall crude output. After testing and commissioning is completed, the LMG project will be subject to final acceptance.

PGNiG completed its exploration programme in Denmark. As no commercial hydrocarbon flow was identified, the Felsted-1 well was abandoned and licence 1/05 expired.

- November

-

PGNiG and OOO Gazprom Export signed an annex to the contract for sale of natural gas to Poland. In connection with the agreement, the arbitration proceedings before the Stockholm Arbitration Tribunal were closed.

PGNiG completed the construction of a high-pressure gas pipeline and fibre-optic cable with related infrastructure from the Kościan gas production facility to KGHM Polkowice/Żukowice. The pipeline will be used to sell natural gas produced at Kościan directly to KGHM Polkowice/Żukowice.

PGNiG published its financial results for Q3 2012. The PGNiG Group reported PLN 48 m in net profit, compared with PLN 1.3 bn of net profit for the corresponding period of the previous year. In Q3 2012, the Group’s net profit declined by 80% on Q3 2011, from PLN 319 m to PLN 65 m. Cumulative loss of PLN 1.8 bn posted by the Trade and Storage segment for the first nine months of 2012 was the key driver of the Group’s operating result. In Q3 alone the segment, which is responsible for handling gas trading, reported a PLN 320 m slide in its operating result, which ultimately arrived in negative territory at PLN -350 m. In Q1-Q3 2012, the Exploration and Production segment generated an operating profit of PLN 1.2 bn , more than for the entirety of 2011, when the profit was PLN 1.1 bn. Key contributors included higher revenue from crude oil sales, continued operating expense discipline (particularly in the area of services and employee benefits) and fewer dry wells. Strong performance was also reported by the Distribution segment.

Moody’s Investors Service (”Moody’s”, “the Agency”) downgraded PGNiG’s credit rating from Baa1 to Baa2 with a negative outlook. According to Moody’s, the downgrade chiefly reflects the deterioration in PGNiG’s operating performance versus 2011 due to the negative margin in its gas trade operations, coupled with higher debt levels on the acquisition of PGNiG Termika. The Agency pointed to the uncertain future set-up of the Polish gas market and its possible adverse impact on the Company’s performance. Another factor taken into account is PGNiG’s evolving business risk profile related to growing expenditure on hydrocarbon exploration and production, which are unregulated business lines. However, the rating agency also noted that the scale of future benefits from the execution of the annex with OOO Gazprom Export will depend on the price quoted to end users of gas.

Standard and Poor’s (“S&P”, “the Agency”) downgraded PGNiG’s credit rating from BBB to BBB- with a stable outlook. According to the agency, the Company sustained the largest gas trading loss on record as the national regulator failed to reflect in time higher prices of imported gas in the sales prices effective in Poland in 2012. The Agency pointed out that the Company’s financial ratios have fallen since 2011 due to negative margins on gas sales and high investment expenditure. S&P believes that the execution of the annex to the Yamal contract for gas supplies with OAO Gazprom / OOO Gazprom Export will enable the Company to avoid further losses and will stabilise its financial performance and credit metrics. The Agency perceived PGNiG’s liquidity as adequate and did not anticipate any significant changes in its business risk profile over the next two years, which was reflected in the stable outlook.

- December

-

The President of the Energy Regulatory Office approved a change to Gas Fuel Supply Tariff No. 5/2012 and extended its effective term until September 30th 2013. On average, the prices and charge rates for the supply of high-methane gas type E, and nitrogen-rich gas types Lw and Ls were reduced by 6.7%, 8.0% and 10.9%, respectively.

The President of the Energy Regulatory Office approved new Tariffs for Gas Fuel Distribution Services for the Gas Distribution Companies.

PGNiG adopted a short-term value creation strategy for the PGNiG Group until 2014. Its objective is to prepare the Company for operating in a liberalised gas market. The PGNiG Group is intent on maintaining its lead in the upstream segment, while remaining the leading supplier of natural gas, who also offers heat and electricity. Thanks to its Short-Term Value Creation Strategy, the PGNiG Group will be able to pursue an ambitious investment programme, while servicing its debt.

PGNiG Norway launched production of oil and gas from the Skarv field.