Letter from the President of the Management Board

Ladies and Gentlemen,

on behalf of the Management Board of PGNiG SA, I have the privilege and pleasure to present to you the PGNiG Group’s Annual Report for 2012. The satisfactory performance delivered by the Group is a solid foundation for the implementation of our ambitious development plans to further the Company’s value in the future – an important factor from our shareholders’ perspective.

In 2012, we again reviewed and assessed the objectives set out in the Company’s strategy for 2011 – 2015. We considered all the variables pertinent to our business environment, such as new economic trends, tendencies in the gas market, and changes in the regulatory framework. As a result, some of the existing assumptions and plans had to be adjusted. The results of our review were used in our Short-Term Value Creation Strategy for 2012 – 2014, the priorities of which are to intensify exploration and production activities, ensure that the Group is well prepared for the gas market’s deregulation, optimise our portfolio of natural gas sources, restructure the Group’s business model and consistently grow the generation segment.

This means that despite a downturn driven by the global crisis, the prospects for natural gas remain bright. We consider the upstream and generation segments as being complementary to each other and as having a lot to offer in potential synergies, therefore we are continuing to develop both of them. Natural gas from indigenous sources should play an increasingly important role in the energy generation sector, and so we continue to uphold our strategic objectives for our own hydrocarbon production.

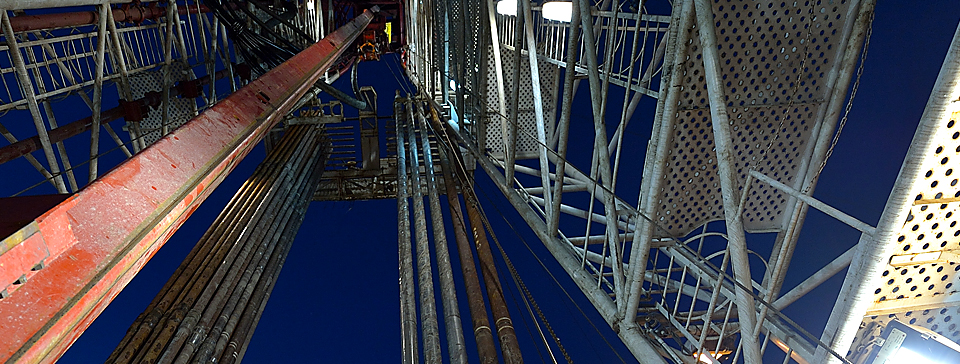

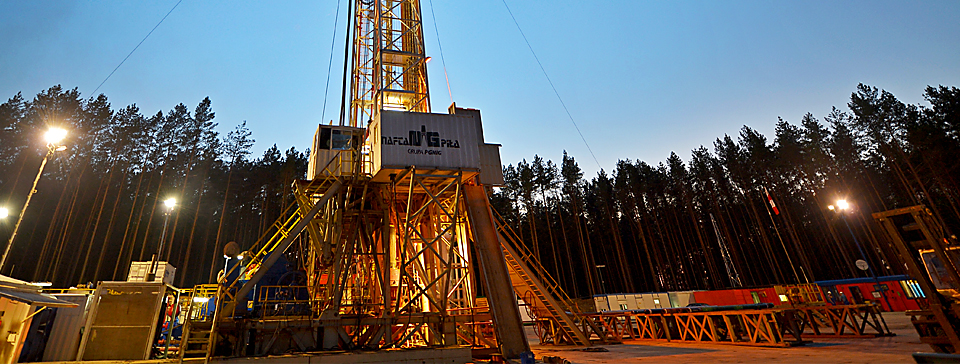

Furthermore, the Company aims to intensify exploration for conventional resources under 80 licences in Poland, and also plans to further optimise exploration and production operations abroad. We are also set to continue exploration for unconventional hydrocarbons, primarily in the Pomerania and Lublin regions, while the launch of production from the Norwegian Continental Shelf and the LMG field in Wielkopolska in late 2012 has considerably strengthened the Group’s production potential.

Compared with the EU average, Poland’s prospects for a marked growth in demand for electricity and natural gas as a fuel for power generation, particularly high-efficient co-generation, remain broad. With a view to diversifying our revenue sources in the future, we are actively engaged in projects seeking to add electricity to our product portfolio. The Group’s entrance into the power generation segment and its involvement in the construction of new gas-fired CHP plants in Poland will enable us to attain that goal and meet the expected market demand. PGNiG’s own generation capacity will facilitate entrance into the electricity trading market with maximum efficiency.

Securing a stable and uninterrupted supply of energy and natural gas for households and institutional customers remains our overriding concern. To attain that goal, we are implementing strategic investment projects to construct and expand our underground storage facilities and distribution pipelines. The increased underground gas storage capacity will enable us to respond flexibly to any disruptions to gas supplies.

Concurrently, we are consistently diversifying our gas import sources. All these measures enable us to procure gas supplies at lower prices and enhance Poland’s energy security. The Moravia interconnector between Poland and the Czech Republic, the expanded Lasów point on the Polish-German border, and the virtual reverse flow through the Yamal pipeline have all contributed to an increased share of gas imported from countries lying south and west of Poland to 18%, which represents 2 bn m³ of natural gas.

We are very satisfied with this past year. The Group’s revenue came in at PLN 28.7 bn, a PLN 5.7 bn rise year on year. Net profit and operating profit amounted to PLN 2.23 bn and over PLN 2.5 bn, respectively. After difficult negotiations with Gazprom, we achieved a record reduction in gas prices in the Yamal Contract. We stepped up our exploration activities, including for shale gas. We are also preparing for the gas market’s deregulation by remodelling our organisation. These efforts have already been acknowledged by the market. In just one year, our stock price gained nearly 30% and PGNiG SA was presented with a “Byki i Niedźwiedzie” (Bulls and Bears) award in the WIG-20 Company of the Year category by Gazeta Giełdy Parkiet. PGNiG has been included in the Warsaw Stock Exchange’s RESPECT Index of socially responsible companies continuously since the establishment of the index, and in April 2012 the Company was named the most socially responsible business in the Fuels and Power category in a ranking compiled by the Dziennik Gazeta Prawna. Although it was a great honour to receive the accolades, we realise that there are still many challenges lying ahead, and so we treat our awards as incentives to our further efforts.

In 2012, we embarked on reorganising our Company’s structure, as part of which we centralised business customer services at the branches and transformed the multiple units responsible for coordinating retail customer service into Regional Sales Offices. Simultaneously, we effected a series of changes in its upstream segment. This led to the establishment of the Geology and Production Branch, charged with coordinating exploration activities and making investment decisions on upstream projects in Poland and abroad. The geology and drilling functions, which had been previously carried out by the Sanok and Zielona Góra branches, were consolidated with the Hydrocarbon Production and Mining Work Department and the Exploration Department operating at PGNiG SA’s Head Office. In Spring 2012, five drilling and well-servicing subsidiaries of the PGNiG Group – PNiG Kraków SA, PNiG Jasło SA, PNiG NAFTA SA, PN Diament Sp. z o.o. and ZRG Krosno Sp. z o.o. – were consolidated into a single company, PGNiG Poszukiwania. Since February 1st 2013, after completion of the legal and organisational merger, the combined entity has been trading under the name Exalo Drilling.

Faced with rapidly-changing energy and gas markets, the impending market liberalisation and the growing burden of new regulatory requirements (including legal obligation to sell gas through commodity exchange), the Group has to implement further changes in order to effectively match its competitors. These changes will affect both wholesale gas portfolio management and the retail sales structure. We will strive to make our offer even better for our customers and to further refine our sales force by leveraging the competitive advantage in the scale of the Company’s operations, our existing customer relationships, and new opportunities offered by the power generation segment.

Finally, it is the people throughout a company’s organisational hierarchy who are responsible for its success, and it is the everyday effort of each of our employees that contributes to the creation of the PGNiG Group’s value. I would like to warmly thank all our employees and Supervisory Board members for their support in building the Company’s current position.

Jerzy Kurella

Vice-President of the Management Board,

acting President of the Management Board of PGNiG SA