Exploration and Production

Geofizyka Kraków

Geofizyka Kraków SA offers geophysical services (2D/3D vibroseis and dynamite data acquisition), well logging data processing and interpretation, measurements, special well interventions, interpretations, perforating and downhole seismic surveys.

In 2012, Geofizyka Kraków generated revenue of PLN 169 m, 59% of which was derived from services rendered in Poland, mainly to PGNiG Group companies. The company rendered 2D and 3D seismic services and performed well logging. Geofizyka Kraków SA was also engaged in seismic data acquisition for Energia Karpaty Zachodnie Sp. z o.o. and carried out microseismic surveys for ENI Polska Sp. z o.o. and the University of Science and Technology in Kraków. On foreign markets, the company provided 2D and 3D seismic services exclusively for third-party customers, i.e. OMV Exploration & Production GmbH in Austria, Hjørring Varmeforsyning in Denmark, RWE Gas Storage in the Czech Republic and OGDCL in Pakistan. Sale of services to third-party customers outside Poland accounted for 41% of the company’s total revenue.

In 2013, on the domestic market, Geofizyka Kraków will provide 2D and 3D seismic services to PGNiG SA. Outside Poland, the company will perform 3D seismic services for OMV Exploration & Production GmbH in Austria and 2D and 3D seismic services for POGC – Libya BV.

| Geofizyka Kraków | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 169 | 247 |

| Net profit (loss) | PLN m | -16 | 9 |

| Equity | PLN m | 86 | 103 |

| Total assets | PLN m | 232 | 236 |

| Workforce as at December 31 | persons | 1,182 | 1,604 |

Geofizyka Toruń

Geofizyka Toruń SA offers a range of seismic services, from design and data acquisition, digital data processing, to comprehensive geophysical and geological interpretations. The company also provides services in the area of well logging and well interventions, including interpretation of well data. Further, the company offers a variety of near-surface geophysical services in the field of geology, hydrogeology and environmental protection, as well as design and delivery of deep anode groundbeds for cathodic protection.

In 2012, Geofizyka Toruń generated revenue of PLN 349 m. Sale of services to customers outside the PGNiG Group accounted for 73% of total revenue. On foreign markets, the company provided services mainly to third-party customers. These included acquisition of 2D and 3D seismic data and were provided in Germany, India, Egypt and Hungary. In Poland, the company continued seismic data acquisition for FX Energy Poland Sp. z o.o., BNK Polska Sp. z o.o. and Wisent Oil&Gas Sp. z o.o. The services provided for entities related to the PGNiG Group included acquisition, processing and interpretation of seismic data and well logging.

In 2013, on the domestic market, Geofizyka Toruń’s operations will include continued acquisition, processing and interpretation of 2D and 3D seismic data and in-well measurements, including data interpretation. The services will be rendered to third-party customers, including FX Energy Poland Sp. z o.o., Cuadrilla Poland Sp. z o.o., Lane Energy Poland Sp. z o.o., and PGNiG. On foreign markets, the company will continue data acquisition projects in Germany and India. Geofizyka Toruń will also execute a new project involving seismic acquisition work in Italy.

| Geofizyka Toruń | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 349 | 371 |

| Net profit (loss) | PLN m | 12 | 21 |

| Equity | PLN m | 189 | 188 |

| Total assets | PLN m | 262 | 253 |

| Workforce as at December 31 | persons | 1,576 | 1,881 |

PNiG Jasło (currently Exalo Drilling SA)

The core business of PNiG Jasło SA comprises drilling of exploration and production wells, well workovers, well abandonment services, provision of specialised well servicing services such as cementing, mud services or completions, as well as operation of drilling rig instrumentation and control systems.

In 2012, the company recorded revenue of PLN 148 m, 75% of which was derived from services rendered to PGNiG. These services included drilling exploratory, appraisal and production wells, remedial treatments, advanced recovery techniques and well abandonment services, as well as specialist services, such as mud, datawell, packer and cementing services. The services provided by the company for third-party customers included drilling gas wells for Orlen Upstream Sp. z o.o. and FX Energy Poland Sp. z o.o., drilling a geothermal well for Termo-Glob Sp. z o.o., as well as specialist services: cementing service for FX Energy Poland Sp. z o.o. and Energia Torzym Sp. z o.o. Sp. k., and packer service for Hydro Nafta Sp. z o.o. The company also provided specialist services abroad: data-well services in Ukraine and cementing services in Lithuania.

| PNiG Jasło (currently Exalo Drilling SA) | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 148 | 302 |

| Net profit (loss) | PLN m | -77 | 2 |

| Equity | PLN m | 66 | 141 |

| Total assets | PLN m | 262 | 280 |

| Workforce as at December 31 | persons | 814 | 917 |

GK PNiG Kraków (currently Exalo Drilling SA)

The PNiG Kraków Group comprises Poszukiwania Nafty i Gazu Kraków SA, as well as its subsidiaries – Oil Tech International – F.Z.E. and Poltava Services LLC. The core business of PNiG Kraków includes geological, exploration and production drilling, well workovers, as well as drilling, testing and well operation services. The company also provides hospitality, catering, rental and training services. Oil Tech International – F.Z.E. provides drilling crews, materials, machinery and equipment. Poltava Services LLC offers drilling and lease of drilling teams.

In 2012, the PNiG Kraków Group generated PLN 333 m of total revenue. Services performed for third-party customers provided revenue of PLN 296 m, which accounted for 89% of the company’s total revenue; exports represented 87% of the total. In 2012, the PNiG Kraków Group continued drilling work in Uganda, Kazakhstan, Pakistan and Ukraine. The group has also signed new contracts for drilling in Uganda, Ukraine and Ethiopia, and commenced work under these contracts. In 2012, the group completed its work in the Czech Republic. On the domestic market, the PNiG Kraków Group’s main customer was PGNiG, for which the group drilled mainly exploratory and appraisal wells, including shale gas exploratory wells.

| PNiG Kraków Group (currently Exalo Drilling SA) | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 333 | 421 |

| Net profit (loss) | PLN m | 16 | 17 |

| Equity | PLN m | 152 | 175 |

| Total assets | PLN m | 488 | 498 |

| Workforce as at December 31 | persons | 1,036 | 1,226 |

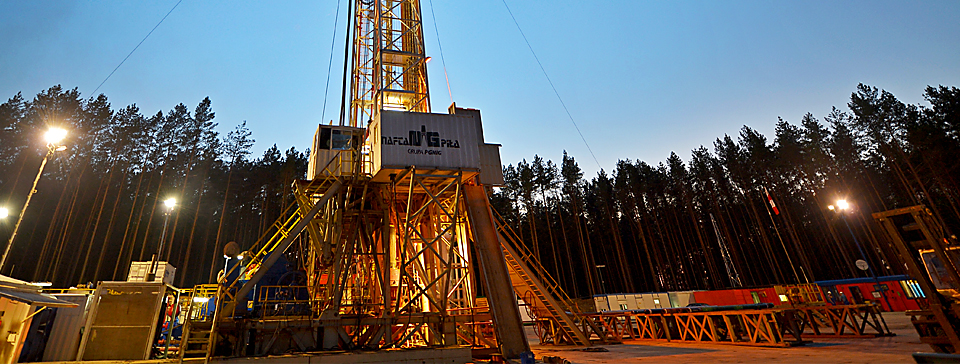

PNiG NAFTA (currently Exalo Drilling SA)

The core business of Poszukiwania Nafty i Gazu NAFTA SA comprises exploration for oil and gas, including in particular design and drilling research, appraisal, exploration and production boreholes and preparation of borehole documentation. The company also drills wells for underground storage of hydrocarbons, plugs wells in depleted fields, works over producing wells, and provides support services through its workshop (specialising in repairs of drilling equipment) and storage facilities.

In 2012, the company posted revenue of PLN 239 m, with 71% of that amount representing sales of services to third-party customers. The company traded mainly on the Polish market. The services primarily included drilling work for Energia Torzym Sp. z o.o. Sp. k., ORLEN Upstream Sp. z o.o. and FX Energy Poland Sp. z o.o. The company also drilled wells for companies exploring for shale gas: Talisman Energy Polska Sp. z o.o., Chevron Polska Energy Resources Sp. z o.o. and ORLEN Upstream Sp. z o.o. Work on foreign contracts included drilling work in Egypt and a new drilling project in Georgia. For PGNiG, the company drilled exploratory wells and performed workovers in Poland.

| PNiG NAFTA (currently Exalo Drilling SA) | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 239 | 302 |

| Net profit (loss) | PLN m | -5 | 16 |

| Equity | PLN m | 188 | 201 |

| Total assets | PLN m | 346 | 359 |

| Workforce as at December 31 | persons | 808 | 860 |

PN Diament (currently Exalo Drilling SA)

The core business of Poszukiwania Naftowe Diament Sp. z o.o. includes specialist well services, including drilling, major remedial treatments, well abandonment services, well testing, downhole measurements, application of enhanced recovery techniques and other services with the use of coiled tubing and nitrogen equipment, and completion, drillstem testing and mud services. The company’s business also includes general, road and environmental construction.

In 2012, PN Diament generated PLN 201 m of total revenue, 55% of which was earned on services rendered to third-party customers. The services provided to third-party customers comprised mainly drilling of research boreholes, including two wells drilled for KGHM Polska Miedź SA in its copper deposits licence area, five wells in Lithuania and two exploratory wells for Liesa Energy Sp. z o.o. The company also performed well servicing in Lithuania, Ukraine, Spain and Romania, and carried out general and road construction work, as well as construction and reclamation of landfill sites.

The projects executed for companies related to the PGNiG Group involved remedial treatments, workovers, well abandonment (including abandonment of PGNiG’s well in Denmark) and other specialist well services, such as mud services, testing and completion, cementing of casing strings, acidizing, setting of cement plugs and services with the use of coiled tubing, slickline and nitrogen equipment.

| PN Diament (currently Exalo Drilling SA) | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 201 | 206 |

| Net profit (loss) | PLN m | 3 | 10 |

| Equity | PLN m | 104 | 103 |

| Total assets | PLN m | 196 | 152 |

| Workforce as at December 31 | persons | 723 | 707 |

ZRG Krosno (currently Exalo Drilling SA)

Zakład Robót Górniczych Krosno Sp. z o.o. is a provider of well servicing services. Its business includes well interventions, such as workovers of active oil and gas wells, shallow drilling, coring, well abandonment services, decommissioning of infrastructure and waste pits, and other reclamation work. The company also performs a wide range of well servicing activities consisting in the application of enhanced recovery techniques, measurements and laboratory services.

In 2012, ZRG Krosno generated PLN 50 m in revenue, with the services provided to PGNiG SA accounting for 55% of the total. The work performed for PGNiG SA consisted in well intervention services, including workovers, well reconditioning, application of enhanced recovery techniques and measurement of reservoir parameters. The company also rendered services to third-party customers in Poland and abroad. In Poland, it completed drilling of a coal well for NWR KARBONIA SA, rendered well stimulation services for Geotermia Podhalańska SA and measured reservoir parameters for DART ENERGY Poland Sp. z o.o. Foreign operations included the workover and plugging of wells for RWE Gas Storage s.r.o. and Unigeo (the Czech Republic) and well stimulation for Tacrom Services s.r.l. (Romania).

| ZRG Krosno (currently Exalo Drilling SA) | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 50 | 72 |

| Net profit (loss) | PLN m | -10 | 1 |

| Equity | PLN m | 32 | 43 |

| Total assets | PLN m | 50 | 59 |

| Workforce as at December 31 | persons | 360 | 395 |

Exalo Drilling

In December 2012, PGNiG consolidated its exploration and service companies within the Group’s Exploration and Production segment. PGNiG Poszukiwania SA was merged with PNiG Kraków SA, PNiG NAFTA SA, PNiG Jasło SA, PN Diament Sp. z o.o. and ZRG Krosno Sp. z o.o. The companies’ assets were transferred to PGNiG Poszukiwania SA, which was renamed Exalo Drilling SA on February 6th 2013. There are plans to raise funds to finance the company’s further development and a stock exchange listing is one of the options under consideration.

In 2013, Exalo Drilling will provide drilling services related to hydrocarbon exploration (including exploration for shale gas), copper exploration and geothermal borehole drilling. The company intends to continue as a provider of well service treatments and well intervention services (in particular workovers), well stimulation, reservoir measurements and well abandonment services.

In Poland, PGNiG will remain an important customer for the company’s services. Its key third-party customers will include Polish and foreign investors holding licences for hydrocarbon exploration in Poland, including Orlen Upstream Sp. z o.o., FX Energy Sp. z o.o., Lane Energy Poland Sp. z o.o. and ExxonMobil Usługi Sp. z o.o. The company also intends to drill for copper for KGHM Polska Miedź SA and Mozów Copper Sp. z o.o., and to drill a geothermal borehole for Geotermia Podhalańska and a ventilation shaft for KWK Knurów-Szczygłowice.

Foreign market operations will involve continued execution of drilling projects in Uganda, Egypt, Ethiopia, Georgia, Kazakhstan, Pakistan, Ukraine and Lithuania, as well as provision of services with the use of coiled tubing and nitrogen equipment and data-well services in Ukraine. The company also plans to render workover and well abandonment services in the Czech Republic.

PGNiG Norway (currently PGNiG Upstream International)

PGNiG Norway AS has been established for the purposes of the Norwegian Continental Shelf project, the aim of which is to provide access to new recoverable reserves of oil and gas outside Poland. The principal business objective of PGNiG Norway is the exploration for and production of crude oil and natural gas on the Norwegian Continental Shelf. The company has been pre-qualified by the Norwegian authorities as an operator.

On the Norwegian Continental Shelf, PGNiG Norway and its partners are implementing the Skarv/Snadd/Idun development project. PGNiG Norway holds a 12% interest in the licence; other interest holders are British Petroleum Norge AS (operator, 24%), Statoil Petroleum AS (36%) and E.ON Ruhrgas Norge AS (28%).

In 2012, following delays due to difficult weather conditions, the finishing work was completed, all subsea structures (foundation slabs, gas pipelines, etc.) were installed, the technical acceptance procedure was successfully completed and the production wells were prepared for coming on stream. December 31st 2012 saw the launch of oil and gas production from the Skarv field.

In 2012, PGNiG Norway was also engaged in exploration work within its other licence areas. The work on the PL212E licence resulted in the discovery of the Snadd Outer field. PGNiG Norway’s interest in the newly discovered field is 15%.

The company will also continue appraisal work in the Snadd Outer field and its exploration and appraisal project in the Snadd field. The company intends to acquire new licence areas by participating in annual licensing rounds or by acquiring interests from other entities. In future, the company wants to participate, as a partner, in drilling projects in deep-sea areas (below 1,000 metres) and in the Arctic Zone.

At the same time, the PGNiG Management Board has decided to integrate all the Group’s foreign upstream operations within PGNiG Norway, whereupon the company will be renamed PGNiG Upstream International.

| PGNiG Norway (currently PGNiG Upstream International) | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 0 | 0 |

| Net profit (loss) | PLN m | 74 | -132 |

| Equity | PLN m | 370 | 291 |

| Total assets | PLN m | 5,019 | 4,661 |

| Workforce as at December 31 | persons | 22 | 23 |

POGC Libya

The core business of Polish Oil and Gas Company – Libya BV (POGC Libya) consists in the exploration for and production of hydrocarbons in Libya. The company conducts exploration work on licence 113 located within the Murzuq petroleum basin, under an Exploration and Production Sharing Agreement of February 25th 2008 concluded with the Libyan government.

In 2012, POGC Libya reopened its Tripoli office and commenced implementation of safety procedures necessary to ensure safety of employees of the Tripoli branch office and of field workers. In the second half of 2012, the force majeure event was declared to have ceased and exploration work under the EPSA was resumed. At the time of resuming the work, the company obtained all necessary drilling permits and ordered performance of preparatory work related to the planned drilling activities.

In 2013, the company intends to complete the preparatory work and drill three exploration wells. The company also plans to commence the last stage of 3D seismic work and acquire an additional 2D seismic survey. In the long run, the company assumes it will be awarded new projects in Libya under the DPSA (Development and Production Sharing Agreement) and EPSA.

| POGC Libya | Unit | 2012 | 2011 |

|---|---|---|---|

| Revenue | PLN m | 0 | 0 |

| Net profit (loss) | PLN m | -9 | -21 |

| Equity | PLN m | 315 | 48 |

| Total assets | PLN m | 321 | 53 |

| Workforce as at December 31 | persons | 58 | 36 |