Exploration & Production

2012 saw the launch of production from the Skarv field on the Norwegian Continental Shelf, as well as completion of the construction work on the Lubiatów-Międzychód-Grotów oil and gas production facility. Exploration work was carried out in Poland, and also abroad, in Norway, Pakistan, Denmark, Egypt and Libya. A 5% growth was achieved in crude oil production, with gas production volumes remaining largely unchanged.

Key achievements in 2012:

- Launch of production from the Skarv field on the Norwegian Continental Shelf

- Start-up of the LMG production facility

- Merger of drilling companies and establishment of PGNiG Poszukiwania

The PGNiG Group’s activities in the Exploration & Production segment include geophysical and geological surveys, as well as drilling of wells and production of natural gas and crude oil. Currently, the PGNiG Group produces natural gas and crude oil from fields located in Poland and Norway. For its needs, the segment uses the capacities of the gas storage facilities in Bonikowo, Brzeźnica, Daszewo, Strachocina and Swarzów.

Financial performance

The Exploration & Production segment derives its revenues mainly from non-regulated sales of natural gas and crude oil, and also from geological, geophysical, drilling and well services.

In 2012, the segment posted PLN 1.35 bn in operating profit, up by PLN 38 m (nearly 3%) on 2011. This robust performance was delivered on increased volumes of crude oil production and sales, following the hook-up of new wells on the Barnówko – Mostno – Buszewo field, and high production rates from wells which had previously been brought on stream. As the prices of Brent oil went up to approximately USD 110/bbl, this had a direct effect on the segment’s operating performance. A non-recurring factor which eroded the segment’s operating result was the recognition of impairment losses on property, plant and equipment, which was tested for impairment in line with the adopted procedures.

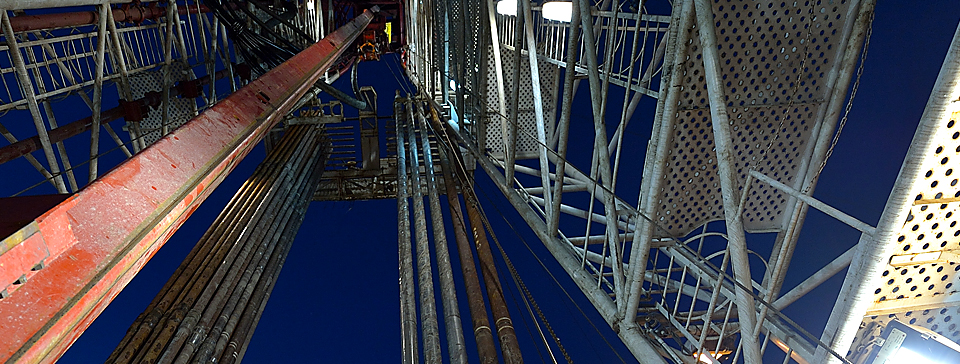

Geological, geophysical, drilling and well services

Exploration for natural gas and crude oil is carried out both in Poland and abroad. The exploration work involves analyses of historical and geological data, seismic surveys and drilling campaigns.

- Drilling services – performed by PGNiG, as well as PNiG Jasło, PNiG Kraków and PNiG Nafta;

- Geological services – seismic acquisition, processing and interpretation of seismic data and well logging services were performed by Geofizyka Kraków and Geofizyka Toruń;

- Well services – specialist services supporting the performance of exploration and production work were provided by Poszukiwania Naftowe Diament and Zakład Robót Górniczych Krosno.

As at the end of 2012, PGNiG held 95 licences for gas and oil exploration and appraisal, covering a total area of 62,360 sq km, 225 licences for gas and oil production in Poland, 9 licences for underground storage of gas, as well as 3 licences for storage of waste and 1 licence for salt deposit appraisal. In 2012, the Ministry of Environment extended the term of PGNiG’s 23 licences for the exploration and appraisal of oil and gas deposits. In addition, 7 production licences were amended, 1 licence was awarded and 1 licence expired.

Work was carried out by the PGNiG Group on 28 boreholes in the Carpathian Mountains, Carpathian Foothills and Polish Lowlands. Out of 23 wells with known test results, 11 were classified as positive (including 9 gas wells and 2 oil and gas wells), whereas the remaining 12 wells were designated as dry.

In 2012, geophysical work was conducted in PGNiG SA’s licence areas in the Carpathian Mountains, Carpathian Foothills and Polish Lowlands, as part of which 1,562.17 km of 2D seismic data and 468.51 sq km of 3D seismic data was acquired.

Consolidation of the exploration and service companies

In December 2012, PGNiG consolidated its exploration and service companies within the Group’s Exploration and Production segment. PGNiG Poszukiwania SA was merged with PNiG Kraków SA, PNiG NAFTA SA, PNiG Jasło SA, PN Diament Sp. z o.o. and ZRG Krosno Sp. z o.o. The companies’ assets were transferred to PGNiG Poszukiwania SA, which was renamed Exalo Drilling SA on February 6th 2013.

Natural gas from unconventional deposits

Unconventional gas sources include shale (shale gas), as well as rock formations (sandstone and lime) where gas is trapped in unconnected pores (tight gas). While unconventional gas-bearing rocks are encountered all over the world, so far they have only been commercially exploited in the US. Production of shale gas in that country has been on a steep upward trajectory – between 1996 and 2006, it grew from 8.5 bn m³ to 25 bn m³.

In Poland, too, there has been growing interest in shale gas, which – according to estimates – is buried at depths ranging from 3,000 metres to 4,500 metres, within a sidelong belt stretching from central Pomerania to the Lublin Province, and within the foreland of the Sudeten Mountains. In recent years, the Ministry of Environment has awarded more than 100 licences for unconventional gas exploration to over 40 entities, including 15 licences to PGNiG. Initial results of the fracturing operation and analysis have indicated the presence of shale gas in Pomerania. In 2012, the Lubocino 2-H horizontal well was drilled, where in December of the same year a fracturing treatment had been performed in Ordovician formations. Fracturing operations have also been performed in Silurian rock formations in the Lubocino-1 vertical well. In the Tomaszów Lubelski licence area, the Lubycza Królewska-1 borehole was drilled and it is the first exploration borehole designed to explore for shale gas in the areas of PGNiG’s licences in the southern part of the Lublin Province.

Also in 2012, the Opalino-2 well was drilled in the Wejherowo licence area in pursuit of two exploration goals: to find shale gas in lower Paleozoic (Silurian and Ordovician strata) and to find conventional gas in upper Cambrian sandstone. The well has already encountered gas in the Cambrian formations. It has also been used to collect material to assess the shale gas potential of the overlying Silurian and Ordovician rocks.

In addition to projects carried out on its own, on July 4th 2012 PGNiG signed a framework agreement on the exploration for and production of shale gas and oil within the Wejherowo licence area with four other Polish companies: TAURON Polska Energia SA, KGHM Polska Miedź SA, PGE Polska Grupa Energetyczna SA and Enea SA. Pursuant to the agreement, the joint operations will focus mainly around the villages of Kochanowo, Częstkowo and Tępcz, on the part of PGNiG’s Wejherowo licence area where preliminary surveys ad analyses confirmed the presence of unconventional gas. The joint effort will cover about 160 sq km in the Wejherowo licence area. Expenditure on the Kochanowo-Częstkowo-Tępcz (KCT) project is estimated at up to PLN 1.7 bn. PGNiG will be the licence operator throughout the exploration and appraisal phase.

Resources/reserves

Poland’s resources are evaluated by the Mineral Resources Commission, and the evaluation is confirmed by the Ministry of Environment. As at the end of 2012, the combined reserves of natural gas and crude oil amounted to 727 m boe, including 576 m boe (89 bn m³) of gas and 151 m boe (20.7 m tonnes) of oil and condensate. In 2012, the total reserves to production ratio (R/P) stood at 23.1.

Production

In 2012, the aggregate production of natural gas and crude oil with condensate was 31.42 m boe, of which gas accounted for 89% and oil with condensate – for 11% of the total output. The respective production volumes were 4.32 bn m³ of natural gas (27.83 m boe) and 491.6 ths tonnes of crude oil with condensate (3.59 m boe). Petroleum production is concentrated in north-western and south-eastern Poland and carried out by two PGNiG Branches – based in Zielona Góra and in Sanok.

PGNiG produces two types of gas with different calorific values – high-methane and nitrogen-rich gas – at 69 production sites located throughout Poland. In 2012, the Sanok Branch produced high-methane and nitrogen-rich gas as well as crude oil from 46 production sites, including 26 gas production facilities and 20 oil and gas production facilities. The Zielona Góra Branch produces crude oil and nitrogen-rich gas from 23 production sites, including 14 gas production facilities and 9 oil and gas production facilities. A portion of the nitrogen-rich gas is further processed at the nitrogen rejection units in Odolanów and Grodzisk Wielkopolski. Once nitrogen is removed, natural gas is pumped into the high-methane gas system. In 2012, the process of conversion of nitrogen-rich gas into high-methane gas yielded 1.42 bn m³ of the product. The process also yields by-products, including liquefied natural gas (LNG), liquid and gaseous helium and liquid nitrogen.

With a view to maintaining the current hydrocarbon production volume or limiting its natural decline, in 2012 major remedial treatments were performed on a total of 24 wells whose technical condition prevented their further operation. Of that number, 19 wells flowed hydrocarbons at commercial rates, 2 were used as injectors and 3 were converted to support underground gas storage. In 2012, well interventions were undertaken on a total of 63 wells, designed to maintain or improve production rates of producing wells or to restore sub-surface extraction equipment to working condition. Interventions were also made on wells supporting the underground gas storage and on injectors.

Crude oil production is concentrated in western Poland, including the currently largest field – BMB (Barnówko-Mostno-Buszewo), which in 2012 accounted for 75% of total oil production in the country (361 ths tonnes). In 2012, the volume of crude oil and condensate production was 491.6 ths tonnes, which represents a year-on-year increase of 24 ths tonnes (5%), up from 467.6 ths tonnes.

One of the major projects implemented in Poland in recent years to increase the production of oil and – to a lesser extent – of gas was the development of the Lubiatów-Międzychód-Grotów (LMG) fields in the vicinity of Gorzów Wielkopolski. The LMG production facility was commissioned in early December 2012. As part of the project, PGNiG constructed the LMG Central Facility (to serve as a hub for collection, separation and treatment of reservoir fluids), as well as the Dispatch Terminal in Wierzbno, to support collection and shipment of crude oil. Crude oil will be transported by rail tankers and injected into the Druzhba pipeline, through which oil flows to Germany. Additionally, any surplus gas production will be transmitted via the pipeline running from the production site to the Grodzisk nitrogen rejection unit. March 2013 saw the official launch of the LMG production facility, which is expected to result in a nearly twofold increase in domestic oil production.

The PGNiG Group’s foreign expansion began in 2007 with the acquisition of an interest in the Skarv/Snadd/Idun exploration & production licence on the Norwegian Continental Shelf. Production from the field was launched in December 2012. The target production volume in 2013 is approximately 100 m m³ of gas and approximately 370 ths tonnes of oil and other fractions. Natural gas will be transported to mainland Europe, whereas crude oil will be sold straight “from the wellhead”.

Sale

Natural gas is sold by PGNiG’s Exploration and Production segment directly from the fields (outside of the transmission system), from which it is supplied to specific customers via dedicated pipelines. Sales are transacted on market terms, and the delivery terms (including pricing) are agreed individually with the customers on a case-by-case basis, depending on the characteristics of a given project. The key group of customers buying natural gas directly from the fields are industrial users (such as Elektrociepłownia Zielona Góra SA, PGE Górnictwo i Energetyka Konwencjonalna SA, Zakłady Azotowe w Tarnowie-Mościcach SA or Arctic Paper Kostrzyn SA). This form of purchase is preferred by customers located in close proximity to the gas production sites. Sale of natural gas directly from the fields enables commercially viable development of gas reserves whose quality deviates from network standards and attracts customers in whose case deliveries of system gas are not feasible for technical or economic reasons.

In 2012, direct sales of gas accounted for approximately 5% of PGNiG’s total sales and amounted to 723.4 m m³, up by 6.1% on 2011. Direct sales from the fields are made both in the case of high-methane and nitrogen-rich gas – in 2012, 72.0 m m³ of high-methane gas and 651.4 m m³ of nitrogen-rich gas (measured as high-methane gas equivalent) were sold in this way.

PGNiG sells crude oil on free market terms, pricing it by reference to the crude prices on international markets. In 2012, crude oil was sold through the following channels:

- via pipeline – to a foreign customer,

- using wheeled transport (by road and rail tankers) – to domestic customers.

In 2012, 43.8% of the total volume of crude sold was transported to a German refinery through the PERN Druzhba pipeline.

Apart from non-tariff sales of gas directly from the fields and oil sales, PGNiG’s portfolio comprises a number of other products, such as helium, nitrogen, sulphur, condensate and propane/butane mix.

The launch of the Lubiatów-Międzychód-Grotów (LMG) project will increase PGNiG’s potential with respect to crude oil sales in the coming years.

Capex projects

The capital expenditure incurred in 2012 in the Exploration and Production Segment amounted to PLN 1.79 bn. The bulk of capital expenditure on the exploration for hydrocarbon deposits in Poland was incurred on seismic surveys, as well as two wells drilled with positive results, two dry wells and other wells on which work was still under way in 2012. Funds were also spent on the Skarv project, which involves the development of fields on the Norwegian Continental Shelf using a floating production, storage and offloading (FPSO) vessel.

Other key capex projects implemented in the upstream segment in 2012 included:

- the LMG project,

- the gas pipeline to KGHM,

- the Góra Ropczycka project,

- the Rylowa Rajsko project,

- projects implemented by the drilling and well services companies.

Other investment projects involved the development of proved or already producing gas reserves, projects executed in order to sustain or restore hydrocarbon production rates, and projects related to the operation of hydrocarbon production.

Starting from 2012, the accounting treatment of seismic work has changed. Under the new approach, expenditure on seismic work is accounted for as expenditure on tangible assets under construction. Previously, it was charged to costs.