1. General Information

1.1. Company name, core business and key registry data

Polskie Górnictwo Naftowe i Gazownictwo Spółka Akcyjna (“PGNiG SA”, “the Company”, “the Parent”), registered office at ul. Marcina Kasprzaka 25, 01-224 Warsaw, is the Parent of the PGNiG Group (“the PGNiG Group”, “the Group”).

On October 30th 1996, the Company was entered in the commercial register maintained by the District Court for the Capital City of Warsaw, 16th Commercial Division, under No. RHB 48382. Currently, the Company is entered in the Register of Entrepreneurs maintained by the District Court for the Capital City of Warsaw, 12th Commercial Division of the National Court Register, under No. KRS 0000059492. The Company’s Industry Identification Number REGON is 012216736 and its Tax Identification Number NIP is 525-000-80-28.

PGNiG SA shares are listed on the Warsaw Stock Exchange (“WSE”). The Company’s core business includes exploration for and production of crude oil and natural gas, as well as import, storage and sale of gas fuels.

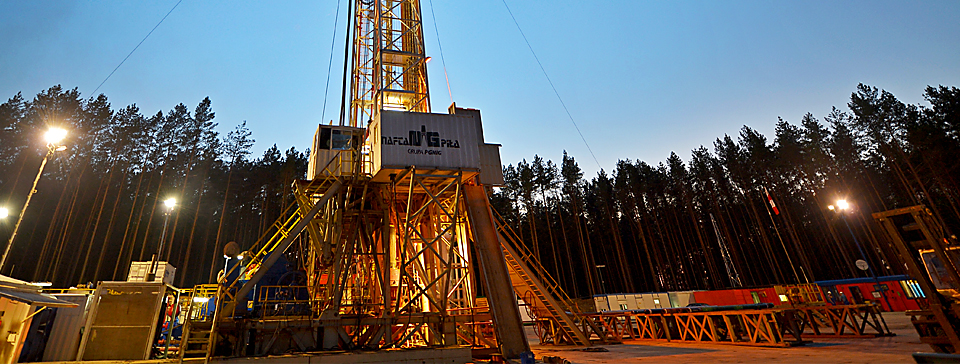

The PGNiG Group remains the only vertically integrated company in the Polish gas sector, holding the leading position in all segments of the country’s gas industry. It is also a major producer of heat and electricity in the country. The scope of the PGNiG Group’s business comprises oil and gas exploration, oil and gas production from fields in Poland, import, storage and distribution of and trade in gas fuels, as well as production of electricity and heat. The PGNiG Group is both the main importer of gas fuel from Russia, Germany and the Czech Republic and the main producer of natural gas from Polish fields. The Company’s upstream operations are one of the key factors building PGNiG’s competitive position on the liberalised gas market in Poland.

The trade in and distribution of natural gas and heat, which together with natural gas and crude oil production constitute the core business of the PGNiG Group, are regulated by the Polish Energy Law. For this reason, the Group’s operations require a license and its revenue depends on the tariff rates for gas fuels approved by the President of the Energy Regulatory Office. Exploration and production activities are conducted on a license basis, subject to the provisions of the Polish Geological and Mining Law.

1.2. Duration of the PGNiG Group

The Company was established as a result of a transformation of state-owned enterprise Polskie Górnictwo Naftowe i Gazownictwo into a state-owned stock company. The Deed of Transformation, together with the Company’s Articles of Association, were executed in the form of a notarial deed on October 21st 1996. The Minister of the State Treasury executed the Deed of Transformation pursuant to the Regulation of the President of the Polish Council of Ministers on transformation of the state-owned enterprise Polskie Górnictwo Naftowe i Gazownictwo of Warsaw into a state-owned stock company, dated September 30th 1996 (Dz. U. No. 116 of 1996, item 553). The joint-stock company is the legal successor of the former state-owned enterprise. The assets, equity and liabilities of the state-owned enterprise were contributed to the joint-stock company and disclosed in its accounting books at their values from the statement of financial position (closing balance) of the state-owned enterprise.

On September 23rd 2005, when new issue shares of PGNiG SA were first listed on the WSE, PGNiG SA ceased to be a state-owned stock company and became a public company.

The Parent and the Group subsidiaries were incorporated for unspecified time.

1.3. Period covered by these consolidated financial statements

These consolidated financial statements present data as at December 31st 2012 and for the period January 1st – December 31st 2012, with comparative financial data for the relevant periods of 2011.

1.4. These financial statements contain aggregated data

These financial statements contain consolidated data of the Parent, its 26 subsidiaries (of which two are parents of their own groups and one group and four companies are indirect subsidiaries), one associate and one jointly-controlled entity.

1.5. Organisation of the PGNiG Group and its consolidated entities

As at December 31st 2012, the Group comprised PGNiG SA (the Parent), and 39 production and service companies, including:

- 25 subsidiaries of PGNiG SA;

- 14 indirect subsidiaries of PGNiG SA.

The list of the PGNiG Group companies as at December 31st 2012 is presented in the table below.

Companies of the PGNiG Group

| No. | Company name | Share capital (PLN) | Value of shares held by PGNiG SA (PLN) | % ownership interest of PGNiG SA | % of total vote held by PGNiG SA |

|---|---|---|---|---|---|

| Direct subsidiaries of PGNiG SA | |||||

| 1 | GEOFIZYKA Kraków S.A. | 64,400,000 | 64,400,000 | 100% | 100% |

| 2 | GEOFIZYKA Toruń S.A. | 66,000,000 | 66,000,000 | 100% | 100% |

| 3 | PGNiG Poszukiwania S.A. (currently Exalo Drilling S.A.) |

981,500,000 | 981,500,000 | 100% | 100% |

| 4 | PGNiG Norway AS | 1,092,000,000 (NOK)1) | 1,092,000,000 (NOK)1) | 100% | 100% |

| 5 | Polish Oil and Gas Company – Libya B.V. | 26,724 (USD)1) | 26,724 (USD)1) | 100% | 100% |

| 6 | PGNiG Sales & Trading GmbH | 10,000,000 (EUR)1) | 10,000,000 (EUR)1) | 100% | 100% |

| 7 | Operator Systemu Magazynowania Sp. z o.o. | 5,000,000 | 5,000,000 | 100% | 100% |

| 8 | Dolnośląska Spółka Gazownictwa Sp. z o.o. | 658,384,000 | 658,384,000 | 100% | 100% |

| 9 | Górnośląska Spółka Gazownictwa Sp. z o.o. | 1 300 338 000 | 1 300 338 000 | 100% | 100% |

| 10 | Karpacka Spółka Gazownictwa Sp. z o.o. | 1,484,953,000 | 1,484,953,000 | 100% | 100% |

| 11 | Mazowiecka Spółka Gazownictwa Sp. z o.o. | 1,255,800,000 | 1,255,800,000 | 100% | 100% |

| 12 | Pomorska Spółka Gazownictwa Sp. z o.o. | 655,199,000 | 655,199,000 | 100% | 100% |

| 13 | Wielkopolska Spółka Gazownictwa Sp. z o.o. | 1,033,186,000 | 1,033,186,000 | 100% | 100% |

| 14 | PGNiG TERMIKA S.A.4) | 862 316 000 | 862,308,730 | 99.99% | 99.99% |

| 15 | PGNiG Energia S.A. | 41,000,000 | 41,000,000 | 100% | 100% |

| 16 | INVESTGAS S.A. | 502,250 | 502,250 | 100% | 100% |

| 17 | PGNiG Technologie S.A. | 166,914,000 | 166,914,000 | 100% | 100% |

| 18 | BSiPG Gazoprojekt S.A. | 4,000,000 | 3,000,000 | 75% | 75% |

| 19 | PGNiG Finance AB (publ) | 500,000 (SEK)1) | 500,000 (SEK)1) | 100% | 100% |

| 20 | PGNiG Serwis Sp. z o.o. | 9,995,000 | 9,995,000 | 100% | 100% |

| 21 | Geovita S.A. | 86,139,000 | 86,139,000 | 100% | 100% |

| 22 | NYSAGAZ Sp. z o.o. | 9,881,000 | 6,549,000 | 66.28% | 66.28% |

| 23 | BUD-GAZ P.P.U.H. Sp. z o.o. | 51,760 | 51,760 | 100% | 100% |

| 24 | Polskie Elektrownie Gazowe Sp. z o.o. | 1,212,000 | 1,212,000 | 100% | 100% |

| 25 | PGNiG SPV4 Sp. z o.o. | 5,000 | 5,000 | 100% | 100% |

| Indirect subsidiaries of PGNiG SA | |||||

| 26 | Poszukiwania Nafty i Gazu Jasło S.A.5) | 100,000,000 | 100,000,000 | 100% | 100% |

| 27 | Poszukiwania Nafty i Gazu Kraków S.A.5) | 105,231,000 | 105,231,000 | 100% | 100% |

| 28 | Poszukiwania Nafty i Gazu NAFTA S.A.5) | 60,000,000 | 60,000,000 | 100% | 100% |

| 29 | Poszukiwania Naftowe Diament Sp. z o.o.5) | 62,000,000 | 62,000,000 | 100% | 100% |

| 30 | Zakład Robót Górniczych Krosno Sp. z o.o.5) | 26,903,000 | 26,903,000 | 100% | 100% |

| 31 | Oil Tech International F.Z.E. | 20,000 (USD)1) | 20,000 (USD)1) | 100% | 100% |

| 32 | Zakład Gospodarki Mieszkaniowej Sp. z o.o. | 1,806,500 | 1,806,500 | 100% | 100% |

| 33 | Biogazownia Ostrowiec Sp. z o.o. | 165,000 | 165,000 | 100% | 100% |

| 34 | Powiśle Park Sp. z o.o. | 81,131,000 | 81,131,000 | 100% | 100% |

| 35 | Poltava Services LLC | 20,000 (EUR)1) | 19,800 (EUR)2) | 99% | 99% |

| 36 | CHEMKOP Sp. z o.o. | 3,000,000 | 2,550,000 | 85% | 85% |

| 37 | GAZ Sp. z o.o. | 300,000 | 240,000 | 80% | 80% |

| 38 | PT Geofizyka Toruń Indonezja LLC w likwidacji | 8,773,000,000 (IDR)1) | 4,825,150,000 (IDR)3) | 55% | 55% |

| 39 | XOOL GmbH | 500,000 (EUR)1) | 500,000 (EUR)1) | 100% | 100% |

1) In foreign currencies.

2) Share capital not paid up.

3) The company's share capital, which following translation into USD amounts to USD 1,000 thousand, has been partly paid up by Geofizyka Toruń Sp. z o.o.: by December 31st 2012 Geofizyka Toruń Sp. z o.o. has paid USD 40.7 thousand.

4) On December 31st 2012, PGNiG Termika S.A. (acquiring company) merged with PGNiG SPV 1 Sp. z o.o. (target company). Following the transaction, PGNiG SA's ownership interest in PGNiG TERMIKA S.A. is 99.99%. For more information, see Note 1.6.

5) The company was transferred as a non-cash contribution to PGNiG Poszukiwania S.A. on August 21st 2012.

Consolidated entities of the Group as at the end of 2012

| No. | Company name | Based in | Ownership interest held by PGNiG SA (%) | |

|---|---|---|---|---|

| Dec 31 2012 | Dec 31 2011 | |||

| 1 | PGNiG S.A. (Parent) | Poland | ||

| Direct subsidiaries of PGNiG SA | ||||

| 2 | GEOFIZYKA Kraków S.A. | Poland | 100.00% | 100.00% |

| 3 | GEOFIZYKA Toruń S.A. | Poland | 100.00% | 100.00% |

| 4 | PGNiG Poszukiwania S.A. (currently Exalo Drilling S.A.) | Poland | 100.00% | - |

| 5 | PGNiG Norway AS | Norway | 100.00% | 100.00% |

| 6 | Polish Oil And Gas Company – Libya B.V. | The Netherlands | 100.00% | 100.00% |

| 7 | Dolnośląska Spółka Gazownictwa Sp. z o.o. | Poland | 100.00% | 100.00% |

| 8 | Górnośląska Spółka Gazownictwa Sp. z o.o. | Poland | 100.00% | 100.00% |

| 9 | Karpacka Spółka Gazownictwa Sp. z o.o. | Poland | 100.00% | 100.00% |

| 10 | GK Mazowiecka Spółka Gazownictwa1) | Poland | 100.00% | 100.00% |

| 11 | Pomorska Spółka Gazownictwa Sp. z o.o. | Poland | 100.00% | 100.00% |

| 12 | Wielkopolska Spółka Gazownictwa Sp. z o.o. | Poland | 100.00% | 100.00% |

| 13 | Geovita S.A. | Poland | 100.00% | 100.00% |

| 14 | INVESTGAS S.A. | Poland | 100.00% | 100.00% |

| 15 | PGNiG Energia S.A. | Poland | 100.00% | 100.00% |

| 16 | PGNiG Technologie S.A. | Poland | 100.00% | 100.00% |

| 17 | Operator Systemu Magazynowania Sp. z o.o. | Poland | 100.00% | 100.00% |

| 18 | GK PGNiG Sales &Trading2) | Germany | 100.00% | 100.00% |

| 19 | PGNiG SPV1 Sp. z o.o.3) | Poland | - | 100.00% |

| 20 | PGNiG TERMIKA S.A.4) | Poland | 99.99 %5) | - |

| 21 | PGNiG Serwis Sp. z o.o. | Poland | 100.00% | - |

| 22 | PGNiG Finance AB | Sweden | 100.00% | 100.00% |

| 23 | BSiPG Gazoprojekt S.A. | Poland | 75.00% | 75.00% |

| Indirect subsidiaries of PGNiG SA | ||||

| 24 | Poszukiwania Nafty i Gazu Jasło S.A.6) | Poland | 100.00% | 100.00% |

| 25 | GK Poszukiwania Nafty i Gazu Kraków6), 7) | Poland | 100.00% | 100.00% |

| 26 | Poszukiwania Nafty i Gazu NAFTA S.A.6) | Poland | 100.00% | 100.00% |

| 27 | Zakład Robót Górniczych Krosno Sp. z o.o.6) | Poland | 100.00% | 100.00% |

| 28 | Poszukiwania Naftowe Diament Sp. z o.o.6) | Poland | 100.00% | 100.00% |

| Equity-accounted jointly-controlled and associated entities | ||||

| 29 | SGT EUROPOL GAZ S.A.8) | Poland | 49.74% | 49.74% |

| 30 | GAS - TRADING S.A. | Poland | 43.41% | 43.41% |

1) The Mazowiecka Spółka Gazownictwa Group comprises Mazowiecka Spółka Gazownictwa Sp. z o.o. and its subsidiary Powiśle Park Sp. z o.o.

2) The PGNiG Sales &Trading Group comprises PGNiG Sales &Trading GmbH and its subsidiary XOOL GmbH.

3) On January 11th 2012, PGNiG SPV1 Sp. z o. o. acquired 99.84% of shares in Vattenfall Heat Poland S.A. (currently PGNiG Termika S.A.). On December 31st 2012, the company merged with PGNiG Termika S.A. and PGNiG SPV1 Sp. z o.o. ceased to exist.

4) On December 31st 2012, PGNiG Termika S.A. and PGNiG SPV1 Sp. z o.o. merged. PGNiG Termika S.A. was the surviving company and became a subsidiary of PGNiG SA.

5) PGNiG SA’s ownership interest in PGNiG Termika, excluding treasury shares held for retirement.

6) A subsidiary of PGNiG Poszukiwania S.A. as of August 21st 2012.

7) The Poszukiwania Nafty i Gazu Kraków Group comprises Poszukiwania Nafty i Gazu Kraków S.A. and its subsidiaries: Oil Tech International – F.Z.E. and Poltava Services LLC.

8) Including a 48.00% direct interest and a 1.74% interest held indirectly through GAS-TRADING S.A.

1.6. Changes in the Group’s structure, including changes resulting from mergers, acquisitions or disposals of the Group entities, as well as long-term investments, demergers, restructurings or discontinuation of operations

Key changes in the PGNiG Group’s structure:

- On January 2nd 2012, the transformation of PNiG Jasło Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On January 11th 2012, PGNiG SPV 1 Sp. z o.o. executed a final share purchase agreement with Vattenfall AB, whereby PGNiG SPV 1 Sp. z o.o. acquired 24,591,544 shares in Vattenfall Heat Poland S.A., which represented 99.84% of the company's share capital and conferred the right to 99.84% of the total vote at the General Meeting of Vattenfall Heat Poland S.A. (currently PGNiG TERMIKA S.A.).

- On January 13th 2012, the Extraordinary General Meeting of PGNiG SPV 1 Sp. z o.o. adopted a resolution to increase the company's share capital by PLN 770,000 thousand, to PLN 770,020 thousand, through the issue of 15,400,000 new shares with a par value of PLN 50 per share. All the new issue shares were acquired by PGNiG SA. The increase was registered with the National Court Register on January 25th 2012;

- On February 16th 2012, the Extraordinary General Meeting of PGNiG Energia S.A. adopted a resolution to increase the company's share capital by PLN 11,000 thousand, to PLN 41,000 thousand, through an issue of 110,000 new shares with a par value of PLN 100 per share. All the new issue shares were acquired by PGNiG SA. The increase was registered with the National Court Register on March 22nd 2012;

- On February 17th 2012, the Extraordinary General Meeting of Pomorska Spółka Gazownictwa Sp. z o.o. adopted a resolution to increase the company's share capital by PLN 1,553 thousand, to PLN 655,199 thousand, through the issue of 1,553 new shares with a par value of PLN 1,000 per share. All new issue shares were acquired by PGNiG SA and paid for with an in-kind contribution in the form of a perpetual usufruct right to land, along with the ownership title to buildings and structures erected thereon. The increase was registered with the National Court Register on March 7th 2012;

- On February 24th 2012, Mazowiecka Spółka Gazownictwa Sp. z o.o. executed two share purchase agreements, under which it acquired in aggregate 58 shares in GAZ Sp. z o.o. of Błonie. As a result, the company's equity interest in GAZ Sp. z o.o. increased to PLN 240 thousand and its share in the company's share capital rose to 80%;

- On February 24th 2012, by virtue of a court decision, NAFTEK Sp. z o.o. w likwidacji (in liquidation) – an indirect subsidiary of PGNiG Technologie S.A. – was deleted from the National Court Register;

- On May 8th 2012, the Extraordinary General Meeting of Al Masharig – Geofizyka Toruń Limited Company adopted a resolution to open liquidation proceedings;

- On May 25th 2012, the transformation of ZRUG Zabrze Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On June 1st 2012, the transformation of PNiG Kraków Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On June 1st 2012, the transformation of PGNiG Technologie Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On June 6th 2012, PGNiG Sales & Trading GmbH acquired 500,000 shares in XOOL GmbH, with a par value of EUR 1 per share. The acquired shares represent the entire share capital of the company;

- On June 14th 2012, the transformation of PNiG NAFTA Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On June 6th 2012, PGNiG SA acquired 100 shares in MLV 26 Sp. z o.o., with a total par value of PLN 5 thousand, representing the entire share capital of the company, for PLN 7,5 thousand. On June 14th 2012, a change of the company's name to PGNiG Serwis Sp. z o.o. was registered with the National Court Register.

On June 15th 2012, the company's Extraordinary General Meeting resolved to increase the company's share capital to PLN 9,995 thousand. All the new issue shares were acquired by PGNiG SA. The increase was registered with the National Court Register on June 29th 2012; - On June 8th 2012, PGNiG SA acquired 100 shares in MLV 27 Sp. z o.o., with an aggregate par value of PLN 5 thousand, representing the entire share capital of the company, for PLN 7,5 thousand. On June 4th 2012, the company's Extraordinary General Meeting resolved to amend the company's Articles of Association. The amendments included a change of the company's name to PGNiG SPV 4 Sp. z o.o. The change was registered with the National Court Register on August 29th 2012;

- On July 2nd 2012, the transformation of GEOFIZYKA Toruń Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On July 2nd 2012, the transformation of GEOFIZYKA Kraków Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On July 2nd 2012, the transformation of Geovita Sp. z o.o. into a joint-stock company was registered with the National Court Register;

- On July 27th 2012, PGNiG Poszukiwania S.A., a company incorporated on July 3rd 2012, was registered with the National Court Register. The company's share capital amounts to PLN 10,000 thousand and is divided into 10,000 thousand shares with a par value of PLN 1 per share. All PGNiG Poszukiwania shares are held by PGNiG SA;

- On August 11th 2012, the General Meeting of PT Geofizyka Torun Indonesia resolved to open liquidation proceedings as of August 15th 2012;

- On August 21st 2012, the Extraordinary General Meeting of PGNiG Poszukiwania S.A. resolved to increase the company's share capital by PLN 971,500,000, to PLN 981,500,000, through an issue of 971,500,000 new shares with a par value of PLN 1 per share and to cover the shares with a non-cash contribution in the form of shares in the following companies:

- 100,000,000 shares in Poszukiwania Nafty i Gazu Jasło S.A.

- 105,231,000 shares in Poszukiwania Nafty i Gazu Kraków S.A.

- 60,000,000 shares in Poszukiwania Nafty i Gazu NAFTA S.A.

- 62,000 shares in Poszukiwania Naftowe Diament Sp. z o.o.

- 26,903 shares in Zakład Robót Górniczych Krosno Sp. z o.o.

- On October 9th 2012, the District Court of Toruń declared the bankruptcy by liquidation of ZRUG Toruń S.A. PGNiG SA holds 130,000 shares in the company, with a par value of PLN 10 per share, representing 25.24% of the company's share capital and of the total vote at the company's General Meeting.

- On October 11th 2012, a share capital increase of ZRUG Zabrze S.A., from PLN 5,250,000 to PLN 11,950,000, was registered with the National Court Register. As PGNiG SA did not participate in the share capital increase, its shareholding in ZRUG Zabrze S.A. was diluted from 11.43% to 5.02%;

- On December 5th 2012, Mazowiecka Spółka Gazownictwa Sp. z o.o. +-sold all 120 shares held in GAZ MEDIA Sp. z o.o. to the Company by way of retirement for consideration;

- On December 18th 2012, Mazowiecka Spółka Gazownictwa Sp. z o.o. acquired 5,000 shares in Powiśle Park Sp. z o.o. from BSiPG Gazoprojekt S.A., thereby increasing its interest in the company to 100%;

- On December 14th 2012, the Extraordinary General Meeting of Biogazownia Ostrowiec Sp. z o.o. adopted a resolution concerning an increase in the company's share capital from PLN 105,000 to PLN 165,000 by way of an issue of 1,200 new shares with a par value of PLN 50 per share. All new issue shares were acquired by PGNiG SA as the only shareholder. The shares will be paid for with a cash contribution of PLN 60,000, made by contractual set-off of liabilities payable by Biogazownia Ostrowiec Sp. z o.o. to PGNiG Energia S.A. under a loan against the amount payable by PGNiG Energia S.A. for the shares. The share capital increase has not been registered with the National Court Register;

- On December 19th 2012, the Extraordinary General Meeting of PGNiG Poszukiwania S.A. resolved to merge the Company with Poszukiwania Nafty i Gazu Kraków S.A., Poszukiwania Nafty i Gazu NAFTA S.A., Poszukiwania Nafty i Gazu Jasło S.A., Poszukiwania Naftowe Diament Sp. z o.o. and Zakład Robót Górniczych Krosno Sp. z o.o. The merger was registered with the National Court Register on February 1st 2013;

- On December 19th 2012, the Extraordinary General Meeting of Przedsiębiorstwo Badawczo Usługowe Petromin Sp. z o.o. resolved to wind up the company and initiate the liquidation process (the company is an associate of PNiG Jasło S.A.);

- On December 31st 2012, the merger of PGNiG TERMIKA S.A. and PGNiG SPV 1 Sp. z o.o. was registered with the National Court Register, with PGNiG Termika S.A. as the surviving company. The merger was effected through the transfer of all assets, rights and obligations of the Target Company (PGNiG SPV 1 Sp. z o.o.) to the Acquiring Company (PGNiG TERMIKA S.A.) in exchange for shares the Acquiring Company will issue to the shareholder of the Target Company (PGNiG SA) – merger by acquisition.

Following the merger, the share capital of PGNiG TERMIKA S.A. amounts to PLN 862,316,000.00 and is divided into 86,231,600 shares with a par value of PLN 10 per share, including 61,601,600 new Series C shares acquired by PGNiG SA in exchange for shares in PGNiG SPV 1 Sp. z o.o. and 24,629,273 treasury shares in respect of which the voting rights are not exercised.

As at the end of 2012, PGNiG SA holds 99.99% of the total vote at the General Meeting of PGNiG TERMIKA S.A.

As at the end of 2012, legal proceedings were under way to establish court deposits as the company could not pay off some of PGNiG TERMIKA S.A.'s minority shareholders whose shares were purchased under Art. 418 of the Commercial Companies Code. Until the court issues final decisions on the establishment of the court deposits with respect to 727 shares in PGNiG TERMIKA S.A., PGNiG SA's ownership interest in the company is 99.99% (71.43% as direct interest and 28.56% as interest held indirectly through PGNiG TERMIKA S.A.); - On January 2nd 2013, the Extraordinary General Meeting of BUD-GAZ PPUH Sp. z o.o. resolved to wind up the company and commence the liquidation process;

- On January 30th 2013, the Extraordinary General Meeting of PGNiG SA adopted a resolution approving the acquisition by PGNiG SA of all new shares in the increased share capital of PGNiG Technologie S.A. of Warsaw, with a total par value equal to the amount resulting from the valuation of up to 30,000 shares in B.S. i P.G. GAZOPROJEKT S.A. of Wrocław, with the shares to be acquired at par value for a non-cash contribution in the form of up to 30,000 shares in B.S. i P.G. GAZOPROJEKT S.A. of Wrocław (PGNiG SA’s total shareholding: 75%).

The shares in B.S. i P.G. GAZPROJEKT S.A. will be contributed at their value determined in the course of the valuation; - On February 1st 2013, the merger of PGNiG Poszukiwania S.A. with five drilling and servicing companies from the PGNiG Group (PNiG Kraków S.A., PNiG NAFTA S.A., PNiG Jasło S.A., PN Diament Sp. z o.o. and ZRG Krosno Sp. z o.o.) was registered with the National Court Register.

As of February 6th 2013 trades as Exalo Drilling S.A., and is currently one of the largest companies in the exploration sector in Central and Eastern Europe.

On February 15th 2013, the Extraordinary General Meeting of PGNiG SPV 4 Sp. z o.o. resolved to increase the company's share capital by PLN 990,000, to PLN 995,000, by way of an issue of 19,800 new shares with a par value of PLN 50 per share, which were subscribed for by PGNiG SA and fully paid for with cash. The share capital increase has not been registered with the National Court Register.

1.7. Composition of the PGNiG Management Board

Pursuant to PGNiG SA’s Articles of Association, its Management Board can consist of two to seven members. The number of Management Board members is determined by the body appointing the Management Board. Management Board members are appointed for a joint term of three years. Individual members or the entire Management Board are appointed by the Supervisory Board. Each member of the Management Board may be removed from office or suspended from duties by the Supervisory Board or the General Meeting.

As long as the State Treasury remains a shareholder of the Company and the Company’s annualised average headcount exceeds 500, the Supervisory Board appoints one person elected by the Company's employees to serve on the Management Board during its term.

As at December 31st 2012, the PGNiG Management Board consisted of four members:

- Ms Grażyna Piotrowska-Oliwa – President of the Management Board;

- Mr Radosław Dudziński – Vice-President, Trade;

- Mr Sławomir Hinc – Vice-President, Finance;

- Mr Mirosław Szkałuba – Vice-President, Procurement and IT.

The following changes in the composition of the PGNiG Management Board occurred in the period from January 1st 2012 until the date of these financial statements:

At its meeting held on March 7th 2012, the PGNIG Supervisory Board appointed Ms Grażyna Piotrowska-Oliwa to the position of President of the Management Board of PGNiG, with effect as of March 19th 2012, for the joint term of office expiring on March 13th 2014.

On May 11th 2012, Mr Marek Karabuła resigned from his position as member of the PGNiG Management Board. The reason for the resignation was his appointment to the position of President of the Management Board of POGC Libya B.V., PGNiG SA's subsidiary.

On January 22nd 2013, Mr Sławomir Hinc tendered his resignation as a PGNiG Management Board member, with effect as of March 31st 2013. The reason for the resignation was his appointment as President (CEO) of PGNiG Norway AS, PGNiG SA's subsidiary, with effect from April 1st 2013.

On February 27th 2013, the PGNiG Supervisory Board appointed Mr Krzysztof Bocian as Vice-President of the Management Board, Exploration and Production, and Mr Jacek Murawski as Vice-President of the Management Board, Finance, with effect as of April 1st 2013, for the joint term of office expiring on March 13th 2014.

1.8. Commercial proxies

As at December 31st 2012, PGNiG SA had no commercial proxies.

On March 21st 2012, the PGNiG Management Board revoked the powers of proxy granted to the following persons:

- Ms Ewa Biernacik, Head of PGNiG Accounting Department;

- Mr Kazimierz Chrobak, Head of PGNiG Zielona Góra Branch;

- Mr Mieczysław Jakiel, Head of PGNiG Sanok Branch.

Subsequent to December 31st 2012, until the date of these financial statements, no commercial proxies were appointed at PGNiG SA.

1.9. Composition of the PGNiG Supervisory Board

Pursuant to the provisions of PGNiG SA’s Articles of Association, its Supervisory Board consists of five to nine members, appointed by the General Meeting for a common term of three years. As long as the State Treasury holds an interest in the Company, the State Treasury, represented by the minister competent for matters pertaining to the State Treasury, acting in consultation with the minister competent for economic affairs, has the right to appoint and remove one member of the Supervisory Board.

One member of the Supervisory Board elected by the General Meeting should satisfy the following criteria:

- they should be elected in accordance with the procedure set forth in Par. 36.3 of PGNiG SA’s Articles of Association;

- they may not be a related party of the Company or any of the Company’s subsidiaries;

- they may not be a related party of the parent or another subsidiary of the parent; or

- they may not have any links to the Company or to any of the entities specified in items 2) and 3) above which could materially affect their ability to make impartial decisions in their capacity as a Supervisory Board member.

The links referred to above do not include the membership in the PGNiG Supervisory Board.

Pursuant to Par. 36.3 of PGNiG SA’s Articles of Association, the Supervisory Board elects the member satisfying the above criteria in a separate vote. Written proposals of candidates for the position of a Supervisory Board member who satisfies these criteria may be submitted by shareholders present at the General Meeting whose agenda includes election of such Supervisory Board member. If no candidates for the position are proposed by the shareholders, candidates to the Supervisory Board who satisfy the above criteria are nominated by the Supervisory Board.

If the Supervisory Board consists of up to six members, two members are appointed from among the candidates elected by the Company's employees. If the Supervisory Board consist of seven to nine members, three members are appointed from among the candidates elected by the Company’s employees.

As at December 31st 2012, the Supervisory Board consisted of nine members:

- Mr Wojciech Chmielewski – Chairman of the Supervisory Board,

- Mr Marcin Moryń – Deputy Chairman of the Supervisory Board,

- Mr Mieczysław Kawecki – Secretary of the Supervisory Board,

- Ms Agnieszka Chmielarz – Member of the Supervisory Board,

- Mr Józef Głowacki – Member of the Supervisory Board,

- Mr Janusz Pilitowski – Member of the Supervisory Board,

- Mr Mieczysław Puławski – Member of the Supervisory Board,

- Ms Ewa Sibrecht-Ośka – Member of the Supervisory Board,

- Ms Jolanta Siergiej – Member of the Supervisory Board.

The following events relating to the composition of PGNiG Supervisory Board took place in 2012:

On January 5th 2012, Mr Stanisław Rychlicki, Chairman of the Supervisory Board, tendered his resignation from the position citing personal reasons, with effect as of January 10th 2012.

On January 12th 2012, the Extraordinary General Meeting of PGNiG SA removed Mr Grzegorz Banaszek from the Supervisory Board, with effect as of January 12th 2012.

At the same time, the Extraordinary General Meeting of PGNiG held on January 12th 2012 appointed to the PGNiG Supervisory Board:

- Mr Józef Głowacki,

- Mr Wojciech Chmielewski.

On January 12th 2012, by virtue of a decision of the Minister of State Treasury, and pursuant to Par. 35.1 of PGNiG’s Articles of Association, Mr Janusz Pilitowski was appointed to the PGNiG Supervisory Board.

On January 13th 2012, the PGNiG Supervisory Board appointed Mr Wojciech Chmielewski as its Chairman.

On March 19th 2012, the General Meeting of PGNiG SA appointed Ms Ewa Sibrecht-Ośka to the PGNiG Supervisory Board.

Subsequent to December 31st 2012 there have been no changes in the composition of the PGNiG Supervisory Board.

1.10. Shareholder structure of PGNIG SA

As at the date of release of these 2012 consolidated financial statements, the only shareholder holding at least 5% of the total vote at the General Meeting of PGNiG SA was the State Treasury.

PGNIG SA ’s shareholder structure was as follows:

| Shareholder | Registered office | Number of shares | % of share capital held | % of total vote |

|---|---|---|---|---|

| As at Dec 31 2012 | ||||

| State Treasury | Warsaw | 4,271,810,954 | 72.40% | 72.40% |

| Other shareholders | - | 1,628,189,046 | 27.60% | 27.60% |

| Total | - | 5,900,000,000 | 100.00% | 100.00% |

| As at Dec 31 2011 | ||||

| State Treasury | Warsaw | 4,272,063,451 | 72.41% | 72.41% |

| Other shareholders | - | 1,627,936,549 | 27.59% | 27.59% |

| Total | - | 5,900,000,000 | 100.00% | 100.00% |

In 2012, the State Treasury’ interest in the Company was reduced by 0.01% due to the ongoing process of delivering the Company shares to eligible employees.

1.11. Going-concern assumption

These consolidated financial statements have been prepared based on the assumption that the Group companies will continue as a going concern for the foreseeable future. As at the date of approval of these financial statements, no circumstances were identified which would indicate any threat to the Group companies continuing as going concerns.

1.12. Business combinations

In 2012, the merger of PGNiG SPV 1 Sp. z o.o. (a PGNiG Group company) with PGNiG Termika S.A. (previously Vattenfall Heat Poland S.A.), acquired on January 11th 2012, was effected.

On December 31st 2012, the merger of PGNiG TERMIKA S.A. and PGNiG SPV 1 Sp. z o.o. was registered with the National Court Register, with PGNiG Termika S.A. as the surviving company. The merger was effected through the transfer of all assets, rights and obligations of the Target Company (PGNiG SPV 1 Sp. z o.o.) to the Acquiring Company (PGNiG TERMIKA S.A.) in exchange for shares the Acquiring Company issued to the shareholder of the Target Company (merger by acquisition). Following the merger, the share capital of PGNiG Termika S.A. amounts to PLN 862.3m and is divided into 86.2m shares with a par value of PLN 10 per share. The acquisition was accounted for in accordance with IFRS 3. For details, see below.

Acquisition of shares in PGNIG TERMIKA S.A. (formerly VATTENFALL HEAT POLAND S.A.)

On January 11th 2012, PGNiG SPV 1 Sp. z o. o., a subsidiary of PGNiG SA, acquired control of Vattenfall Heat Poland S.A. (currently PGNiG Termika S.A.), whose core business is high-efficiency cogeneration of heat and electricity. PGNiG SPV 1 Sp. z o. o. acquired 99.84% of shares, conferring the right to 99.84 of the total vote in the company. Pursuant to the preliminary share purchase agreement, the purchase price was PLN 2,957.4m. Under the final share purchase agreement, that price was increased to include interest at the rate of 5% for the period of four months starting from the agreement execution date, and 6% for the period starting with the fifth month after the agreement execution date and ending on the date on which control of the company was taken over. The final purchase price was PLN 3,016.7m.

The acquisition of control over PGNiG Termika S.A. will enable the PGNiG Group to diversify its revenue sources, in line with the PGNiG Group's updated strategy, which provides for power generation being one of the Group's three key growth areas.

With this transaction, the PGNiG Group has advanced on a path to becoming a multi-utility group, supplying heat, electricity and gas to its customers.

The table below presents the value of consideration transferred and the values of acquired assets and assumed liabilities estimated as at the date of these financial statements.

a. Consideration paid

in PLN m

| Jan 11 2012 | |

|---|---|

| Cash | 3,017 |

| Total consideration paid | 3,017 |

| Buy-back of minority interests | 4 |

| Total consideration paid recognised in the statement of cash flows | 3,021 |

b. Identifiable acquired assets and assumed liabilities

in PLN m

| Jan 11 2012 | |

|---|---|

| Property, plant and equipment | 2,758 |

| Investment property | 6 |

| Intangible assets | 841 |

| Inventories | 362 |

| Receivables | 280 |

| Derivative financial instrument assets | - |

| Cash and cash equivalents | 189 |

| Other assets | 13 |

| Deferred tax assets | 29 |

| Trade and other payables | (993) |

| Employee benefit obligations | (92) |

| Provisions | (34) |

| Accruals and deferrals | - |

| Deferred tax liabilities | (380) |

| Total identifiable net assets | 2,979 |

c. Goodwill

The Group measured goodwill as at the acquisition date as:

- the fair value of consideration paid; plus:

- the fair value of non-controlling interests in the acquired entity; less:

- the fair value of identifiable acquired assets and assumed liabilities.

The goodwill recognised in connection to the acquisition was measured in the following manner:

in PLN m

| Jan 11 2012 | |

|---|---|

| Total acquisition price | 3,017 |

| Fair value of identifiable net assets | (2,979) |

| Fair value of non-controlling interests | 4 |

| Goodwill | 42 |

The goodwill as at the transaction date, i.e. PLN 42m, represents the synergies and economies of scale expected from the acquisition of shares in PGNiG Termika S.A.

It will not be possible to account for the recognised goodwill for the purpose of corporate income tax.

d. Costs of the acquisition

In 2012, PGNiG SPV 1 Sp. z o.o. incurred PLN 11m in costs related to the acquisition. These included mainly costs of advisory services, transfer tax and brokerage fees. These costs were recognised in the PGNiG Group's profit or loss for the reporting period ended December 31st 2012.

e. Non-controlling interests

An 0.16% non-controlling interests in PGNiG Termika S.A. was measured at fair value as at the acquisition date.

The fair value of the shares was determined based on the provisions of the preliminary share purchase agreement, whereby the employees holding shares in PGNiG Termika S.A. have the right to sell these shares at a price equal to the price at which PGNiG SPV 1 Sp. z o.o. acquired the shares. The fair value of non-controlling interests thus estimated is approximately PLN 4m.

Throughout 2012, the Group acquired the majority of non-controlling interest.

f. Acquired receivables

in PLN m

| Main classes of receivables | Gross value | Impairment loss | Fair value |

|---|---|---|---|

| Trade receivables | 276 | (2) | 274 |

| Other receivables | 6 | - | 6 |

Impairment loss on the receivables represents the value of cash flows with respect to which there are doubts as to whether they will be received in full.

g. Intangible assets

In its statement of financial position, the Group recognised identifiable intangible assets, acquired as part of the acquisition, separately from goodwill.

As a result of the acquisition, intangible assets of PLN 242m were identified which had not previously been recognised in the financial statements of the acquired entity. These assets included chiefly carbon emission allowances allocated to the entity, as well as agreements, concluded on favourable terms, for the purchase of coal, sale of electricity and sale of proprietary rights embodied in certificates of origin for electricity. These agreements have been executed for a period of at least one year, and provide for fixed sale/purchase prices.

The identified intangible assets relating to the agreements entered into by the entity are amortised throughout the term of the agreements to which they relate. Once used, the identified carbon dioxide emission allowances are to be written down (as amortisation expense).

In 2012, PLN 242m was charged as amortisation expense upon the use of the identified assets.

in PLN m

| Category | Value |

|---|---|

| Carbon emission allowances allocated for 2012 | 194 |

| Coal purchase agreements | 19 |

| Electricity sales agreements | 3 |

| Agreements for sale of certificates of origin | 26 |

| Total | 242 |

h. Property, plant and equipment

As part of the acquisition, some property, plant and equipment were identified which had not previously been recognised in the financial statements of the acquired entity. These included primarily land and land held in perpetual usufruct, which the acquired entity used although it did not hold a relevant ownership title. The fair value of the land and perpetual usufruct rights is PLN 54.7m. The acquired items of property, plant and equipment have been measured at fair value by an independent appraiser and this valuation may be subject to further changes. Further, the value of the property, plant and equipment was increased by borrowing costs of PLN 10m.

i. Effect of the acquisition on the financial performance of the acquirer

As the acquisition took place at the beginning of the reporting period, the entire profit or loss of the acquiree was accounted for in the profit of the PGNiG Group for the reporting period ended December 31st 2012.

1.13. Approval of the financial statements

These financial statements will be submitted to the Parent's Management Board for approval and published on March 19th 2013.