PGNiG Group Strategy for 2017-2022

Mission

Mission

We are a trustworthy supplier of energy for households and businesses

- Trustworthy: the customers can depend on premium quality and reliability of our services

- Energy supplier: our customers are offered a full range of energy products (gas + electricity + heat + other/services)

- Households and businesses: we care for and value all our customers: households, businesses, and institutions

Vision

We are a responsible and effective provider of innovative energy solutions

- Responsibly: we act transparently, in line with the principles of corporate social responsibility

- Effectively: we have implemented process and cost optimisation measures

- Innovative solutions: we are an innovation leader in the energy sector

Primary objective

Increasing the PGNiG Group’s value and ensuring its financial stability

- Value growth: our primary ambition is to create added value for our shareholders and customers

- Financial stability: we seek to secure long-term financial stability and creditworthness

On March 13th, 2017 the PGNiG Supervisory Board approved the new “PGNiG Group Strategy for 2017−2022 (extended until 2026)”. The new strategy was drafted in response to multiple changes in the internal and external environment of the PGNiG Group.

The key external changes were of a macroeconomic nature (e.g. falling crude oil and natural gas prices), but they were also related to other market developments such as fiercer competition on the Polish gas market, the need to diversify gas imports from 2022 onwards (expiry of the Yamal contract), and changes in the regulatory regime (gradual exemption from the obligation to seek tariff approval, unpredictable future of the support mechanism for power generation beyond 2018). Following an analytical review, the key macroeconomic assumptions underlying the strategic forecasts were updated, including those related to gas, oil and electricity prices. Also, the Group’s new strategic objectives and ambitions until 2022 were formulated.

One major internal change driven by the adoption of the new strategy is the PGNiG Group’s new the Balanced Scorecard (BSC) approach to strategic management based on sustainable strategic management. Its purpose is to balance financial, operating and growth goals from four key ‘perspectives’ (finance, customers, processes and resources and growth). The outcome is a new approach to defining the main strategic objectives with targets and ambitions being set at the Group level and then cascaded down to the Group’s key business divisions.

The Group’s Strategic Objectives

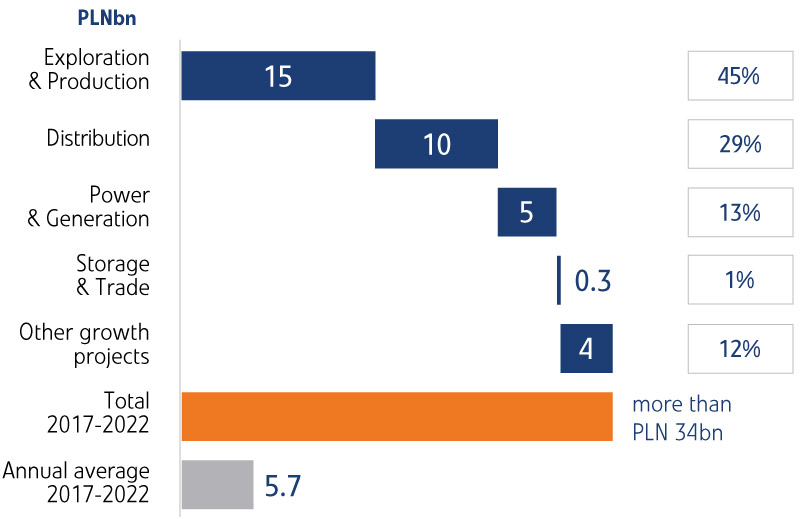

The PGNiG Group’s strategy defines its new overriding objective of growing value and securing financial stability through sustainable development by making investments that offer higher yields (by earmarking roughly 45% of the group’s overall capex for upstream projects) and by focusing on regulated businesses that offer considerable investment safety (by earmarking roughly 42% of total capex for gas distribution, heat and power generation).

Priority areas of strategic investments and development

Additionally, ca. PLN 4bn of capex will be allocated to other growth projects, primarily in distribution, trading, heat and power generation. The Company plans for total capex to exceed PLN 34bn in 2017–2022.

Capital expenditure (CAPEX) for 2017-2022

The investment programme should deliver a cumulative EBITDA of ca. PLN 33.7bn over 2017–2022, driving the long-term growth of the Group’s EBITDA in 2023–2026 to an annual average of ca. PLN 9.2bn.

At the same time, the net debt to EBITDA ratio should stay below 2.0 in this period while maintaining the Group’s current dividend policy of paying up to 50% of the Group’s consolidated net profit*. The PGNiG Management Board always takes into account the PGNiG Group’s current financial standing and its investment plans before giving dividend payout recommendations.

EBITDA for 2017-2022

Ambitions in key business areas

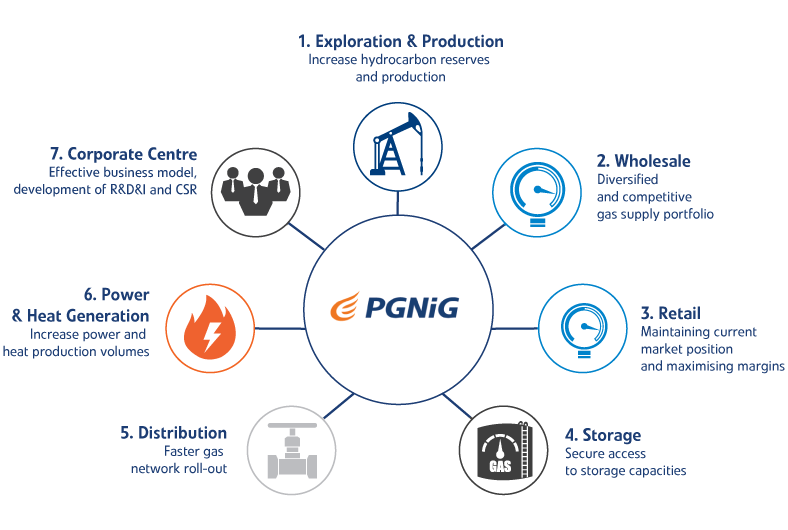

Our Strategy identifies seven key business areas with the following strategic objectives and ambitions in 2017−2022:

barrel of oil equivalent (1 barrel is uqal to approximately 0.136 tonnes or 159 litres)

Exploration & Production

- Increase documented hydrocarbon reserves by 35% (to 1,208 mm boe in 2022)

- Increase annual hydrocarbon production by 41% (to 55 mm boe in 2022)

Wholesale

- Diversified gas supply portfolio after 2022

- Increasing the overall volume of natural gas sales by 7% (to 178 TWh in 2022)

- Cumulative natural gas sales volume on wholesale markets in Poland and abroad 1000 TWh

Retail

- Maximising retail margins

- Maintaining the total volume of retail gas sales at ca. 67-69 TWh/year

Storage

- Securing access to storage capacities adjusted to current demand

- Improve storage efficiency

Distribution

- More than 300 thousand new service lines in 2017–2022

- Raise the annual growth rate measured by the number of service lines by 17%

- Increase gas distribution volume by 16% (to 12.3 bcm in 2022)

Power & Heat Generation

- Increase power and heat sales volume by 20% (to 18 TWh in 2022)

Corporate Centre

- Effective execution of R&D&I projects and enhancing the PGNiG Group’s image

- Operational efficiency improvement across the PGNiG Group

Ambitions in key business areas